Search Posts

Recent Posts

- Outdoors in RI: Help keep recreation areas clean. Invasive Milfoil, trash. 2A update – Jeff Gross July 26, 2024

- Real Estate in RI: Highest-ever sale in Queen’s Grant, EG $1.25M, by Residential Properties July 26, 2024

- Homeless in RI: Gov. Newsom issues Executive Order. Remove California’s encampments. July 26, 2024

- Let the games begin. XXXIII Summer Olympics – John Cardullo July 26, 2024

- GriefSPEAK: What would you do? – Mari Dias Nardolillo July 26, 2024

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

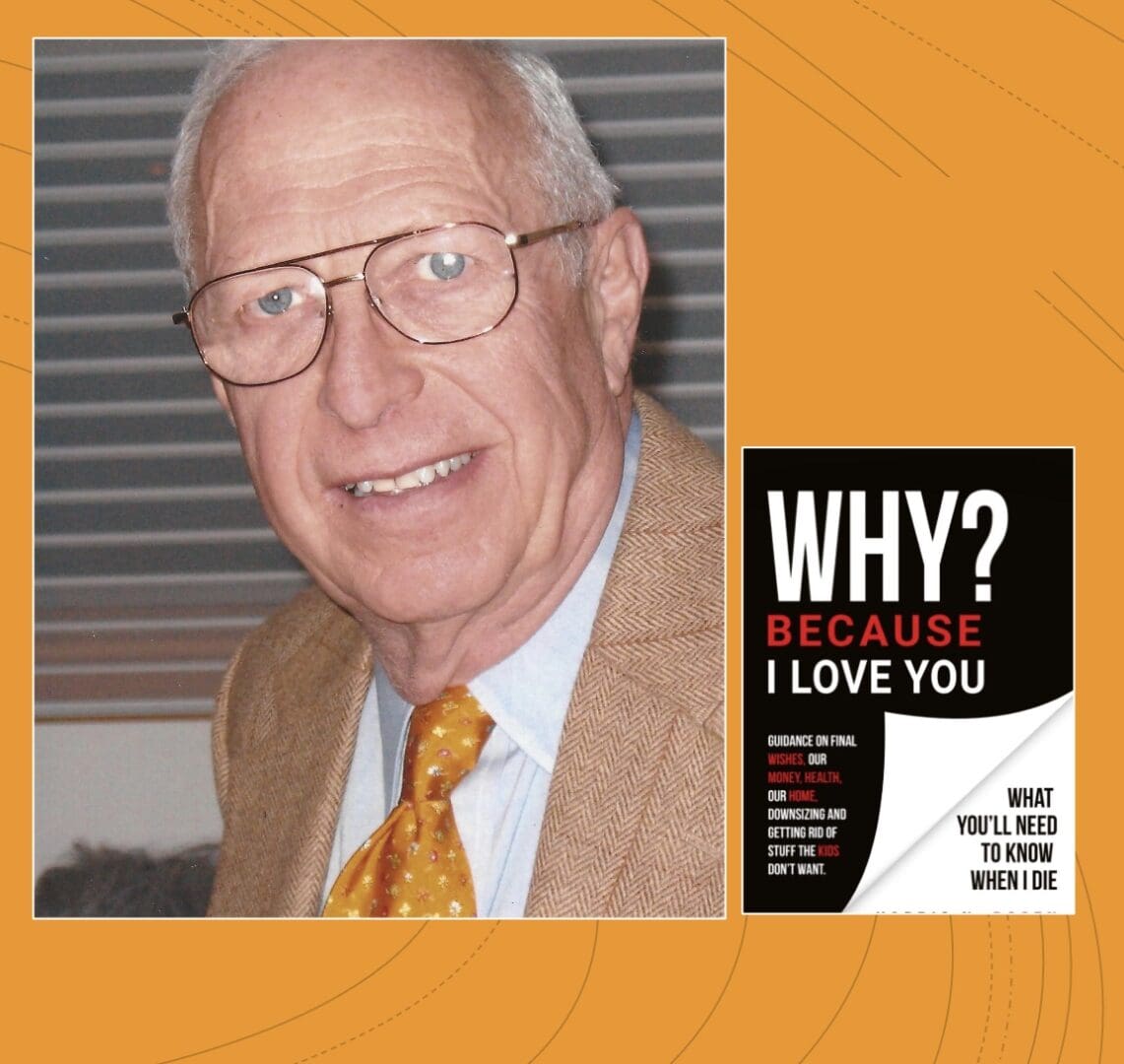

Organizing your information – for others. When in doubt, never throw it out! – Harris N. (Hershey) Rosen

by Harris N. Hershey Rosen, contributing writer, author, “Why? Because I Love You”

Throwing documents and paper records away should not be done in haste or in doubt. Be certain before you take that final step.

Part of gaining control of your finances is knowing not only where documents are but also when to dispose of them – if ever.

But how long should receipts, bills and paperwork be kept? This depends on what it is, and in many cases, whom you ask. To make matters simpler, I’ll provide a list of documents and when I recommend you dispose of them. Remember, too, that you can – and sometimes should – scan in documents and keep them in a file on your computer – label it properly and have it accessible to others who may need that important information in their future.

Speaking of disposal, you should shred anything you don’t need to keep. If you purchase your own shredder, be sure it’s a “cross-cut” one. Otherwise the machine will cut papers into long bands which could be pieced easily back together.

In addition, you can use Google or Facebook events to find a community shredding event – sometimes in a police station or shopping center parking lot – and these are usually free, though the amount you can bring can be limited to a box or two. Another choice is to take our documents to a company who will do it for you, and there are those who will stop at your home to do the shredding.

My book considers this topic and includes an Appendix that will serve as easy reference. Some of the items to toss might surprise you – some “save forevers”, too – so, here we go:

What to Shred and When

Never

Social security card

Papers for purchase, improvements, or sale of homes, vehicles, boats

Mortgage paperwork and payments

Loan documents

IRA contributions

Annual retirement and investment statements

Tax returns and paperwork relating to taxes

Pension plan documents

Certificates for birth, adoption, marriage, divorce and death

Deeds, trusts and wills

Medical and prescription records

Active life insurance policies

Military discharge records

Instruction books for current appliances and electronics

When Warranty Expires:

Bills and checks or receipts for payment of items as well as the warranty itself

After 7 Years:

Checks for charitable donations, tax payments and receipts for other tax-deductible expenses

After 1 Year:

Cancelled checks (but see 7 years above)

Paycheck stubs

Utility bills

Medical bills

Bank statements

Inactive insurance policies

Other paid bills

After you receive an annual statement or W2:

Monthly retirement and investment statements.

After 5 days:

Credit card statement unless needed for tax purposes.

After Receipt of Monthly Statement:

Credit card receipts

ATM and ban deposit receipts

Immediately:

Unless listed above, anything that shows your social security number, birth date, your signature, account numbers, passwords, PIN numbers

Used airline tickets

Pre-approved credit card applications

Expired driver’s licenses, medical data and passports

Unneeded copies of documents listed in the “Never” paragraph above.

What a gift this Mother’s Day to make a commitment to get hold of your paper, organize it, toss it out, store it properly, label it and document what everything is and where it is. Do it together, or do it for someone you love – but do it. It’s a start – flowers, chocolates, gifts and/or brunch not excepted!

_____

Harris “Hershey” Rosen, is the author of WHY? Because I Love You, a book that says it like it is – “What you need to know when I die”. His book details methods to organize your important personal and family information for those who are left behind.

A graduate of Harvard, Hershey Rosen has focused on controlling chaos since 1954. He was a Financial Control Officer in the U.S. Army, where he received a Letter of Commendation for improvement to its worldwide accounting system. Next, on to satisfying everyone’s sweet tooth, he ran a candy company for 40 years, developing a system for locating ANY item housed in five factories, covering 600,000 square feet.

Following “retirement,” Hershey went on to become a mediator and settled over 200 disputes for the state of Rhode Island and The Community Mediation Center of Rhode Island. He was also asked to team-teach management courses at the University of Rhode Island, where he enthusiastically challenged the text book with real-life experiences, to the delight and edification of the students.

Always passionate about assisting others, Hershey has been a director or trustee of numerous boards and organizations. He has written Creating A Guide So Your Loved Ones Can Go On Living! to help others protect their spouses (and families) from the intense stress that will occur if one does not share financial information and knowledge critical to a functioning home. He then wrote My Family Record Book, expanding on the information in his first book, and finally, in 2020, WHY? Because I Love You was published.

Hershey, who lives in Providence, Rhode Island, can now relax (ha!) with his beloved wife, Myrna, and enjoy visits with their combined five children and ten grandchildren.

“WHY? Because I Love You” – available here: https://amzn.to/32iXJqq