Search Posts

Recent Posts

- To Do in RI: 2-day Newport Flower Show – Authors on floral design to speak June 21, 2025

- In the News… quick recap of the week’s news 6.21.25 June 21, 2025

- Providence Art Club Prestigious National Open Juried Exhibition Begins June 21, 2025

- Burn with Kearns: “30-day Shreds” Fail the 50+ Market. What To Do. – Kevin Kearns June 21, 2025

- Rhode Island Weekend Weather for June 21/22, 2025 – Jack Donnelly June 21, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

Countdown to 2024 elections heating up about what to do about Social Security – Herb Weiss

By Herb Weiss, contributing writer on aging issues

The political clock is ticking. It’s 340 days before the upcoming presidential elections and control of Congress and the White House are up for grabs. As education, abortion, foreign policy, immigration, crime are emerging as upcoming campaign issues, fixing Social Security and Medicare are also on the voter’s radar screens, too.

As the Democrats call for expanding and shoring up the existing Social Security Program (by introducing H.R. 4583, Social Security 2100 Act and S. 393, Social Security Expansion Act and other legislative proposals), Republicans are calling for changes in the program including looking at raising the eligibility age for full-time retirement, possible means-testing, and adjusting benefits for higher income earners.

The Nov. 9th Republican debate was not reassuring for younger taxpayers who are counting on collecting the Social Security benefits they earn with every paycheck, says Max Richtman, President and CEO, National Committee to Preserve Social Security & Medicare. Two of the GOP presidential hopefuls promised, in effect, to cut Social Security for future beneficiaries,” he said.

However, former President Donald J. Trump, who didn’t participate in this debate, has warned the other candidates not to make cuts in Social Security and Medicare benefits. While he opposes raising payroll taxes to ensure the fiscal solvency of these programs, he doesn’t provide specific proposals as how to do this.

Presidential GOP candidates call for fixes to an unsustainable Social Security system

According to Richtman, Nikki Haley claimed that Social Security is going “bankrupt,” and she would raise the retirement age for workers who are now in their 20s, and also means-test benefits. Chris Christie also said he would raise the retirement age and eliminate benefits for higher earners, essentially converting Social Security into a safety net program, instead of an earned benefit.

“Governor Christie and Ambassador Haley fail to recognize that future generations of retirees will rely on their Social Security benefits even more than today’s seniors do — and that means testing would cut deep into the heart of the American middle class,” says Richtman. “Ron DeSantis — to his credit — promised not to cut Social Security, but demonstrated a fundamental misunderstanding of the program’s finances by perpetuating the myth that the government is ‘stealing’ from the trust fund,” he added.

On Oct. 25, the newly sworn in Republican House Speaker, Mike Johnson (R-LA) sent a message to his caucus calling for Social Security and Medicare reforms to be made by a debt commission to tackle changes being targeted for these programs. Richtman warns that this approach is “designed to give Congress political cover for cutting Americans’ earned benefits.” In response, the Biden Administration described such a commission as a “death panel” for Social Security.

Over six years ago, Congressman Johnson (now newly elected House Speaker) called for cuts to Social Security. According to Independent News Network, Meidas Touch Network, in a 2018 speech before the American Enterprise Institute, as incoming chair of the Republican Study Committee, he called for cuts in Social Security, Medicare and Medicaid. He viewed these programs as “essential threats” to the American way of life, even suggesting that the government might cease to exist if they continued to be fully funded the way they are now.

Slashing SSA benefits through a Debt Reform Commission

“That is why these commissions have been rightly described as ‘death panels’ for Social Security and Medicare. It is unfortunate and disappointing that one of the Speaker’s first priorities is creating a mechanism intended to slash programs that American workers pay for in every paycheck, fully expecting the benefits to be there when they need them,” says Richtman, charging that the House Speaker “clearly wishes to break this compact with the American people.”

“Congress should address Social Security in the sunlight, through regular order, as it always has,” said Nancy Altman, President of Social Security Works, and former top assistant to Alan Greenspan on the 1983 commission. “The only reason to create a fast-track, closed door commission is to overthrow the will of the American people by cutting their hard-earned benefits. Anyone who supports this commission is supporting benefit cuts.”

In a Nov. 13 correspondence to Congress, Jo Ann C. Jenkins of the Washington, DC-based AARP, also opposes the creation of s debt commission. She strongly disputes the GOP’s claim that Social Security is a driver of the annual deficits or national debt, stressing that the program is self-financed.

According to Jenkins, 90% of the retirement program is financed through payroll contributions from workers and their employers. Around 4% of its funding comes from federal income taxes on some Social Security benefits and 5.4% comes from interest earned on U.S. Treasury bonds held by the Social Security Trust Funds.

“Any argument that claims that Social Security is a driver of the national debt – simply because it receives interest from the U.S. Treasury bonds- is disingenuous,” says Jenkins, noting that U.S. Treasury bonds are of the world’s safest investments.

Alex Lawson, Executive Director of the Washington, DC-based Social Security Works, agrees with Richtman’s assessment of House Speaker Johnson’s ongoing approach to Social Security and Medicare. “The Louisiana Congressman recently joined the vast majority of his caucus to vote for a commission designed to fast-track cuts to Social Security and Medicare behind closed doors”, notes Lawson.

“As Chair of the Republican Study Committee from 2019-2021, Johnson released budgets that included $2 trillion in cuts to Medicare and $750 billion in cuts to Social Security,” says Lawson. This includes raising the retirement age, decimating middle class benefits, making annual cost-of-living increases smaller and ultimately moving towards privation of Social Security and Medicare,” he notes.

With Johnson pushing for the creation of a debt commission, over 100 organizations have become co-signers on Nov. 8 correspondence to Congress opposing the legislative proposal.

Aging groups begin to mobilize

While the Social Security Trust Fund Report, released in April 2023, warned that Social Security funds will become depleted in 2033, making the program totally insolvent in 2034 when beneficiaries could only receive about 80 percent of their scheduled benefits, the cosigners say the program’s projected short falls are “manageable by size and still a decade away, are fully understood.”

“In this Congress alone, several legislative proposals that do just that have been introduced with numerous cosponsors. The only reason to make changes to Social Security via a closed-door commission is to cut already modest earned benefits — something the American people overwhelmingly oppose — while avoiding political accountability, say the co-signers.

“Congress already has a process to confront the federal debt. That process is known as reconciliation. Revealingly, Social Security cuts are excluded from the reconciliation procedure, because, as previously stated, the program is totally self-funded, cannot pay benefits or associated costs without the revenue to cover the costs, has no borrowing authority, and, therefore, does not add a penny to the deficit. Consequently, if a debt commission with jurisdiction over Social Security were to be formed, its purpose would be clear: to cut its modest benefits, while avoiding political accountability,” warn the cosponsors.

But the shortfall is real

In an article in Money magazine, the writer notes, “Taxpayer funds cover the bulk of Social Security payments, but if the program’s reserves run dry, beneficiaries would face immediate 20% cuts to their checks come 2034. Any decrease to Social Security payments would likely be extremely unpopular, considering they’re a major source of retirement income for tens of millions of people.” According to a new report from the American Academy of Actuaries, the longer the issue is put off, the harder it will be to address the looming shortfall.

The Third Rail of national politics

According to AARP research, “85% of older Americans, regardless of party, strongly oppose targeting Social Security and Medicare to reduce federal budget deficits. Specifically, the survey found that 88 percent of Republicans, 79 percent of Independents, and 87 percent of Democrats strongly oppose cutting Social Security. Similarly, 86 percent of Republicans, 80 percent of independents, and 88 percent of Democrats said they strongly oppose cutting Medicare.”

Washington insiders consider Social Security to be the “third rail of a nation’s politics”, a metaphor coming from the high-voltage third rail in some electric railway systems. Stepping on it usually results in electrocution and the use of the term in the political arena refers to “political death”.

Next November, can the GOP politically survive stepping on the third rail by targeting the nation’s most popular social welfare programs (Social Security and Medicare) for adjustments to reduce the federal budget deficit? When the dust settles after November, 2024 elections, we’ll see if younger voters, who have the most to economically lose, view Social Security and Medicare as a key issue influencing their vote and “untouchable.”

We’ll see.

___

To read other columns by Herb Weiss, go to: https://rinewstoday.com/?s=herb+weiss

Herb Weiss has enjoyed a distinguished 43-year career in journalism, earning a national reputation as an expert on aging, health care and medical issues. Over 900 articles that he has authored or co-authored have appeared in national, state and local publications and newspapers. Locally, Weiss’ has weekly newspaper columns appears in the Blackstone Valley Call & Times, and in RINewsToday. Articles also appear in the Warwick Beacon and Cranston Herald and Senior Digest.

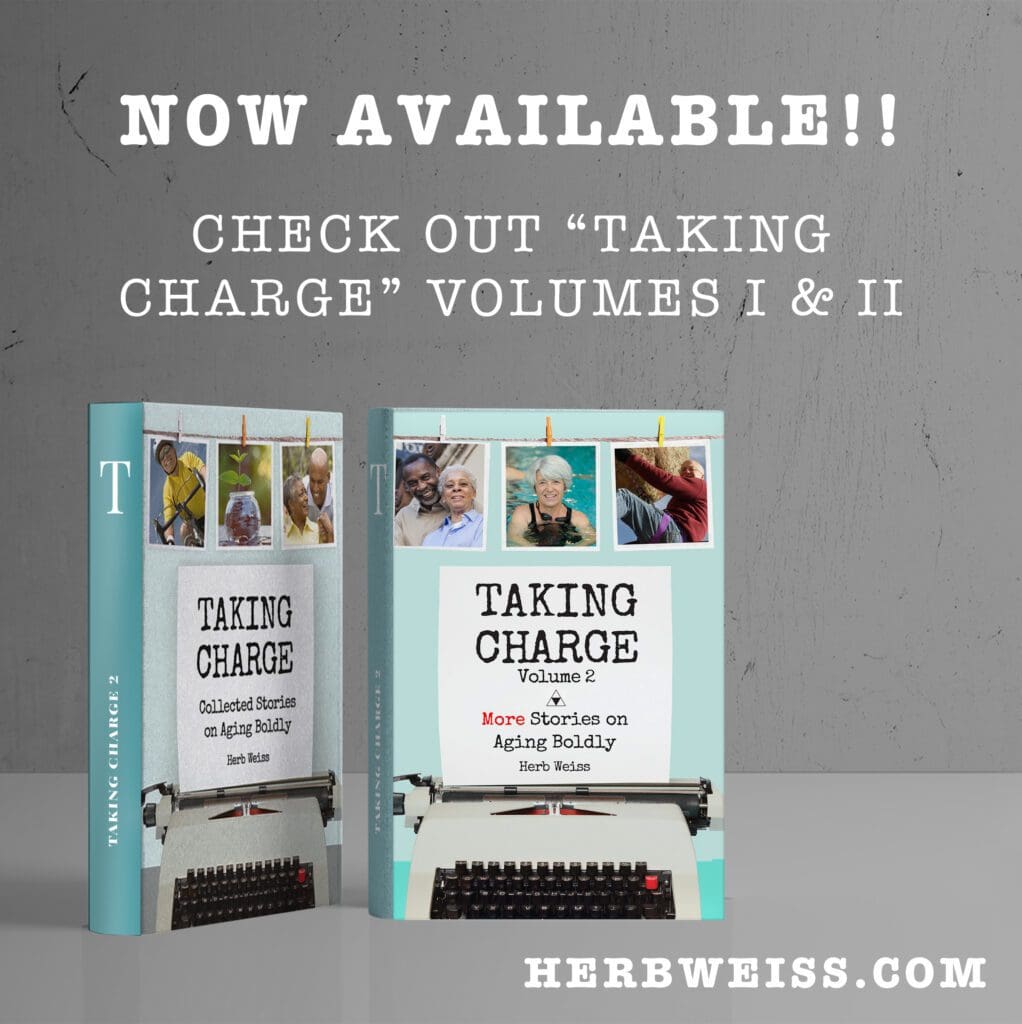

In 2016, he published his first book, a collection of his articles for seniors, called Taking Charge: Collected Stories on Aging Boldly. Herb has published an additional anthology of his collected articles and columns in 2021 called Taking Charge, Volume 2: More Stories on Aging Boldly.

He is a recipient of the 2003 AARP Rhode Island’s Vision Award for his weekly commentary that appeared in the former Pawtucket Times. He is a two-time recipient (1994 and 1999) of the American College of Health Care Administrator’s National Award for his coverage of long-term care issues.

He was also awarded the Distinguished Alumni’s Award by the Center for Studies in Aging, North Texas State University, in 1997, for his career coverage of aging issues. That year, he was also selected by the prestigious McKnight’s LTC News to be one of its “100 Most Influential People” in Long-Term Care.

Herb has been appointed by 5 governors to serve on the Rhode Island Advisory Commission on Aging. The appointments were made by Governors Bruce Sundlun (1994), Lincoln Almond (1999, 2000), Donald L. Carcieri (2005), Gina Raimondo (2016), and Daniel J. McKee (2022). He was also appointed by Rhode Island Senate President Dominick J. Ruggerio in November 2021 to serve on the Advisory Council on Alzheimer’s Disease Research and Treatment.

Herb is a 2012 graduate of the Theta II Class of Leadership Rhode Island.

This is a very informative article explained well by Mr. Weiss. Any insecurity in Social Security can be traced to Wall Street and profit margins. FDR and Congress established Social Security in 1935, immediately after the disastrous Great Depression. Seniors then, had no ‘fail safe plan’ and many were not physically able to go back to many former jobs. In a sense, FDR envisioned a plan to save now, while working, and have a fall back retirement plan when physical labor became too difficult. To accomplish this, the employee banked a percentage of his or her pay every check and the employer matched it. It was part of doing business. Inflation at that time was seldom greater than 3% on average with a few spikes from time to time. Since the ‘banking’ was based on pay, the more one made the more the contribution to fund social security. FDR required it of everyone.

Over time, Congress passed laws which were very generous to company owners. They still had to do their share of funding Social Security but a myriad of laws increased business deductions which certainly changed the tax structures that existed in that 1935 era. As businesses prospered, so did investors on Wall Street. And to keep investors investing, the investments needed to be profitable. We’ve all heard of the ‘Trickle Down’ theories popular during the Reagan presidency, make the rich richer and it will trickle down to the workers. But even prior to Reagan, we saw massive movement of unionized businesses to southern states where unions were not nearly as prominent. Profits stayed high. Eventually the unions caught up. By then, relocating businesses off-shore took hold. There were no unions to deal with, no labor laws to adhere to, no matching Social Security payments, and social programs like Medicare, health insurance, etc. we’re not common in other countries. Yes, there were import taxes but the savings off-shore far exceeded those costs.

So here we are now, talking about cutting Social Security. Going back to a pre-Great Depression time. Don’t we ever learn?

Maybe, just maybe, manufacturing in our own country and our businesses focusing more on protecting our nation’s workers than profits for themselves and Wall Street, is the better choice. Once Social Security is destroyed, there will be no turning back. Do we really want to go back 100 years and lose everything we’ve gained.

Quite frankly, anyone suggesting a depletion of Social Security and Medicare to name just two key programs that everybody will come to rely on, should never be elected again.