Search Posts

Recent Posts

- It is what it is – Jen Brien April 24, 2024

- Time for Sour Grapes – Tim Jones April 24, 2024

- Tenor and Pianist, Michael DiMucci: Songs From the Heart at Linden Place Mansion April 24, 2024

- World War II Veteran, Louis Dolce, turns 100 – TODAY April 24, 2024

- Rhode Island Weather for April 24, 2024 – John Donnelly April 24, 2024

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

AARP Report: Scammers targeting military community – Herb Weiss

By Herb Weiss, contributing writer on aging issues

Just two days before the nation celebrated Veterans Day, the Washington, DC-based AARP issued a report revealing that veterans, active-duty service members, and their families are nearly 40% more likely to lose money to con-artists than the civilian population. According to the new research study, detailed in a 26-page report, 4 out of 5 military/veteran adults were targeted by scams directly related to their military service or the benefits they receive.

Fraud cost veterans, service members and their families more than $338 million in the five years ending in 2019, notes AARP citing Federal Trade Commission (FTC) data. The median loss for military scam victims in 2019, $894, was nearly triple that for the population at large.

“Our research shows scammers are taking aim at the veteran and military community at alarming rates, emphasizing the importance of staying up-to-date on the latest scams and how to avoid them,” said Troy Broussard, Senior Advisor, AARP Veterans and Military Families Initiative. In a Nov. 9 statement announcing the survey’s findings.“ Knowing the red flags can not only help veterans, military and their families avoid losing money, but also avoid the emotional toll from scams,” he said.

AARP’s report, “Scambush: Military Battle Surprise Attacks from Scams & Fraud,” prepared by Jennifer Sauer, AARP Research and Pete Jeffries, AARP Veterans and Military Family Initiative, noted that scammers will use military jargon and specific government guidelines to craft an effective scam pitch to steal money from military members and veterans. One in three military/veteran adults reported losing money to these types of service-related scams.

Many military/veterans survey respondents fell for the Benefit Buyout scam by turning over U.S. Department of Veterans Affairs pension and/or disability benefits for a supposed lump-sum payment that never materializes (47%). Thirty-two percent admitted they were scammed out of money by paying for updated personal medical records, a service provided for free (Fraudulent records scam). Finally, 32% reported that they donated to fake veteran charities.

According to the AARP report, military/veteran adults also reported losing more money than civilians on the grandparent-impostor scam (more than twice as often) and financial phishing schemes (nearly twice as often). Nearly half of military/veteran adults said they are not using a robocall blocking service and over 1 in 4 have not registered their phone numbers on the National Do Not Call Registry. Finally, 81% of military/veteran adults have not placed a security freeze on their credit report.

Fight Back Against Scams

The U.S. Department of Veterans Affairs (VA) and Federal Trade Commission (FTC) provides helpful tips here: https://www.aarp.org/money/scams-fraud/info-2019/veterans.html?intcmp=AE-FWN-LIB4-POS16 to protect yourself against con artists who call you about your government and service benefits.

Unsolicited calls offering you an increase in your military benefits or access to little-know government programs are likely scams.

Never pay for copies of your military records. These documents are free.

You can confirm if a VA phone call is legitimate by calling the agency directly at 1-800-MYVA411.

Hang up if you receive an unsolicited call from a VA representative asks you for personal information like your Social Security number. Personal data is NEVER requested by either phone or email.

Be cautious on returning calls displayed on your caller ID. Scammers can use technology to change the telephone number, called ID spoofing, to make a call appear it came from a different person or place, or even from someone you know.

VA does not threaten claimants with jail or lawsuits. If the caller does this, it’s a scam.

When you have a benefits issue, contact a VA-accredited representative. The VA maintains a searchable database of attorneys, claims agents and veterans service organizations.

Take Advantage of These Resources…

AARP’s Fraud Watch Network recommends also recommends the signing up for the National Do Not Call Registry and using a call-blocking service. Additional measures include: using strong and unique passwords for each online account; using two-factor authentication when available; and placing a free security freeze on credit reports at each of the three major credit bureaus. Remember, veterans never have to pay for their service records or earned benefits—if told otherwise, it’s a scam.

Operation Protect Veterans—a joint program of the AARP Fraud Watch Network and the U.S. Postal Inspection Service—helps veterans, service members and their families to protect against fraud. The Fraud Watch Network also offers biweekly fraud alerts and a free Helpline (877-908-3360) through which veterans, military and the public can report suspected scams. The AARP Watchdog Alert Handbook: Veterans’ Edition explains 10 ways that con artists target veterans.

AARP’s survey was administered in August 2021 to a total of 1,660 people: 851 active or former U.S. military respondents and 809 non-military (civilian) adults ages 18 and older using NORC’s AmeriSpeak Internet Panel. The margin of error is 4.40% at the 90% confidence level.

To get a copy of “Scambush: Military Battle Surprise Attacks from Scams & Fraud,” go to https://www.aarp.org/content/dam/aarp/research/surveys_statisti.cs/econ/2021/fraud-scams-military-veterans-report.doi.10.26419-2Fres.00502.001.pdf

For more information and resources for veterans on the latest fraud and scams, visit aarp.org/veterans.

_____

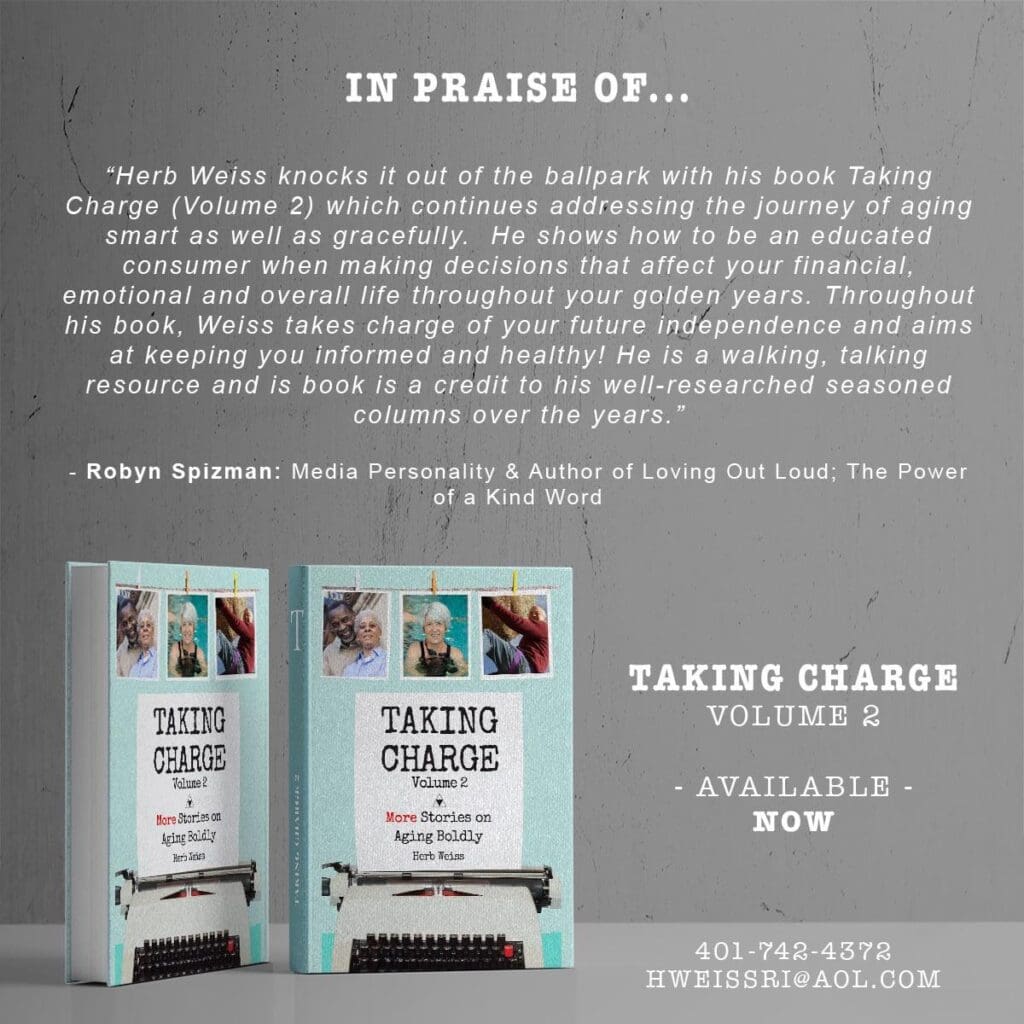

Herb Weiss, LRI’12 is a Pawtucket writer covering aging, health care and medical issues. To purchase Taking Charge: Collected Stories on Aging Boldly: Vol 1, and its sequel, Taking Charge: Vol 2 More Stories on Aging Boldly, go to herbweiss.com.