Search Posts

Recent Posts

- Outdoors in RI: Help keep recreation areas clean. Invasive Milfoil, trash. 2A update – Jeff Gross July 26, 2024

- Real Estate in RI: Highest-ever sale in Queen’s Grant, EG $1.25M, by Residential Properties July 26, 2024

- Homeless in RI: Gov. Newsom issues Executive Order. Remove California’s encampments. July 26, 2024

- Let the games begin. XXXIII Summer Olympics – John Cardullo July 26, 2024

- GriefSPEAK: What would you do? – Mari Dias Nardolillo July 26, 2024

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

The legislative wish list of Rhode Island’s groups on aging – Herb Weiss

by Herb Weiss, contributing writer on aging issues

The Rhode Island General Assembly’s 2024 session kicked off on Jan. 2, 2024, scheduled to adjourn on June 30, 2024. According to LegiScan, over the last three months 2,164 bills have been thrown into the legislative hopper.

“The state budget will likely be voted upon by the House Finance Committee in late May or early June. Then a week later it is considered by the full House of Representatives, followed by votes by the Senate Finance Committee and the full Senate, and the final step would be consideration by the Governor. That process is usually completed by mid-June to late June because the new fiscal year begins on July 1.” says Larry Berman, who has served as House Communication Director for 22 legislative sessions.“

According to Berman, the Senate and House both focus on their priorities within their own chambers first, and once those bills pass, then discussions take place between the leadership teams of both chambers to finalize bills for passage in both chambers before sending them to the Governor. That time period will be May, and well into June.

Legislative Wish List

Aging advocates are pushing for their legislative agenda’s to be included in the House budget. They also are carefully monitoring the status of bills that have been introduced, specifically those that will have an impact on programs and services delivered to older Rhode Islanders.

Maureen Maigret, Policy Advisor, of Senior Agenda Coalition of RI (SACRI) puts the passage of H 7333 and S 2399 on ita priority legislative list to assist financially struggling seniors and persons with disabilities on Medicare. “As many older adults are struggling financially, SACRI is prioritizing H7333 (by Rep. Karen Alzate) and S2399 (by Senator Sandra Cano) to expand the Medicare Savings Program eligibility up to $28,000. These bills would put more money in the pockets of lower-income persons not on Medicaid by covering the Medicare Part B premiums that amount to $2,100 a year and also help them with prescription drug costs,” she says.

To provide financial help to our many unpaid caregivers we also support S2375 (by Rep. Linda L. Ujifusa) and H7490 (by Rep. Susan Donovan) to create a state tax credit up to $1,000 for half the costs incurred to care for an older family member needing supports and S2121 (by Sen. Valarie J. Lawson) and H 7171 (by (by Rep. Joshua J Giraldo) to increase the Temporary Caregiver Insurance program from six to 12 weeks.

According to Maigret, there are a number of bills addressing housing issues that SACRI also supports including those to promote ADU development, funding for affordable senior housing and incorporating accessibility features into new housing.

H. 7062, sponsored by Rep. June S. Speakman has passed the House. This bill would boost hosing production by helping Rhode Islanders to develop ADUs has been identified by as a high priority this year for House Speaker K. Joseph Shekarchi (D-Dist. 13, Warwick).

“In looking at the Governor’s State FY2025 budget we are advocating to add about $660,000 to the Office of Healthy Aging budget to increase funding to local communities to support local senior centers/programs to reach a level of $10 per each person age 65 and older in the city or town,” notes Maigret. SACRI calls for increased funding to implement the recommended increases for social and human services providers beyond the one-third level proposed by the Governor to help address the long wait list for accessing homecare services and provide more livable homecare staff wages. This is critical as the average private cost of home health aide services in RI is $36/hour, she notes.

“ As our industry continues to fight off the existential threats of inadequate funding and staffing shortages, our Association is staying laser focused on our homes receiving sufficient and sustainable financial reimbursements and supporting all initiatives to improve staff availability. Without substantive help from the General Assembly, we will continue to lose more homes and our ability to care for our most fragile RI citizens,” states John E. Gage, MBA, NHA, president and CEO of the Rhode Island Health Care Association.

At AARP Rhode Island’s 2024 Legislative reception, State Director Catherine Taylor called for passage of H 7127 to provide an optional, voluntary Roth-IRA plan to the 172,000 Rhode Island employees who do not have access to a convenient, low-cost voluntary retirement savings plan through their employer.

The Secure Choice program, endorsed by Gov. Dan McKee and AARP Rhode Island, would be administered by the office of the General Treasurer, would see retirement savings accumulated in individual accounts for the exclusive benefit of the participants or their beneficiaries.

The legislation has been referred to the House Finance Committee. A similar measure (S 2045) has been introduced in the upper chamber by Sen. Meghan E. Kallman.

According to Taylor, Secure Choice has been enacted in 18 states to date. In Connecticut, the program led to over 25,0000 workers saving over $19 million dollars in the first year of operation. These savings would not have been realized without Secure Choice.

Taylor also noted that Rhode Island is one of only 8 states that tax hard-earned Social Security benefits. “Our state tax on Social Security undermines the purpose of Social Security, which was designed to lift older adults out of poverty – not to fund state government,” she says.

AARP Rhode Island supports the efforts of Sen. Elaine Morgan (S 84) to completely eliminate the state tax on Social Security income and Sen. Walter Felag (S 246) to increase the thresholds to $ 110,000 for single, and $ 140,000 got joint filers, says Taylor.

“We would like to see the passage of S. 2556 [by Senators Lou Dipalma, Bridget Valverde, John Burke, and Pam Lauria] and H. 7493, sponsored by Rep. Scott Slater and Rep. Grace Diaz, that would establish a 20% add-on to the Medicaid per diem rate for nursing homes that have single-occupancy rooms and bathrooms,” says James Nyberg, executive director of LeadingAge RI.

According to Nyberg, there is a growing body of research that shows the benefits of single rooms on residents’ physical ad mental health and well-being, which was clearly exposed by the COVID-19 pandemic. “There is also the simple fact that it promotes human dignity. Older Rhode Islanders should not have to share a bathroom and shower with strangers during a frail time of life,” he says.

“As for the budget, we want to ensure that the nursing home funding included in the Governor’s budget is maintained, and the Office of the Health Insurance Commissioner recommended rate increases be expedited, if possible, as well,” says Nyberg.

Just a Few More to Watch

Here is a sampling of other bills, of interest to aging advocates, thrown into the legislative hopper this legislative session:

Sen. Linda L. Ujifusa and Rep. Megan Cotter are sponsoring a bill (H 7208, S 2063) to provide relief to some of the state’s most vulnerable households by raising the eligibility limit and the maximum credit for the “circuit breaker” tax credit, which benefits low-income seniors and individuals with disabilities. The bills have been referred to their chamber’s Finance Committee.

The circuit breaker credit program provides an income tax credit to low-income Rhode Island homeowners and renters who are over 65 or disabled, equal to the amount that their property tax exceeds a certain percent of their income. That percent ranges from 3 to 6 percent, based on household income. In the case of renters, a figure representing 20 percent of their annual rent is used in the place of property tax in the calculation.

The Senate approved S 2082, sponsored by Sen. Melissa A. Murray, to limit insured patients’ co-pays for supplies and equipment used to treat diabetes to $25 for a 30-day supply.

The legislation would apply to private insurers, health maintenance organizations, nonprofit hospital service or medical service corporations and the state employee health insurance plans that cover such supplies. Under the bill, beginning Jan. 1 (or, for state employees, the next time the health plan contract is purchased or renewed by the state), co-pays for insulin administration and glucose monitoring supplies shall be capped at $25 for a 30-day supply, or per item when an item is intended to be used for longer than 30 days.

During this legislative session, S 0089 and H 5417 were introduced by Senator Meghan Kallman and Rep. Evan P. Shanley and take their savings with them when they change jobs. The legislative proposals have been referred to the House Finance and Senate Committees for consideration.

For more details about legislation being considered by the Rhode Island General Assembly, go to https://legiscan.com/RI/legislation/2024.

___

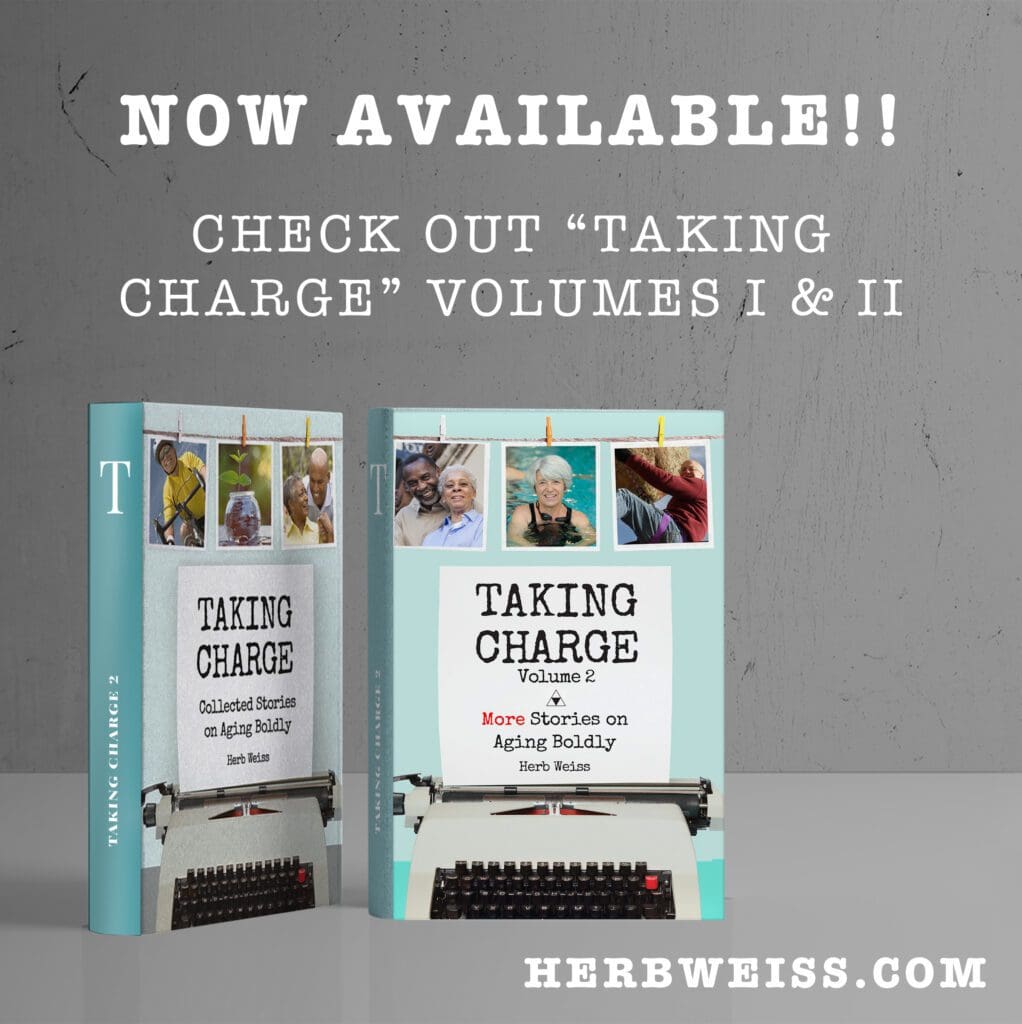

Herb Weiss, LRI -12, is a Pawtucket-based writer who has covered aging, health care and medical issues for over 43 years. To purchase his books, Taking Charge: Collected Stories on Aging Boldly and a sequel, compiling weekly published articles, go to herbweiss.com.