Search Posts

Recent Posts

- Gimme’ Shelter: Pocahontas at the Providence Animal Control Center May 11, 2025

- Rhode Island Weather for May 11, 2025 – Jack Donnelly May 11, 2025

- Jealous of my trellis? – James Dulley May 11, 2025

- 28+ agencies to offer information at Community Resource Fair, May 12th. Sponsored by RI Energy May 11, 2025

- Ask Chef Walter: Eggless cakes – Chef Walter Potenza May 11, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

The CARES Act – what will $2 Trillion do for me?

The Congress was instructed to “go bold, be brave, go big” – and they did. The CARES Act is a substantial help to Americans – not to think another, 4th package, won’t one day be needed.

Coronavirus Aid, Relief and Economic Security Act:

Reprinted from the Tax Foundation:

- Unemployment insurance provisions now include an additional $600 per week payment to each recipient for up to four months, and extend UI benefits to self-employed workers, independent contractors, and those with limited work history. The federal government will provide temporary full funding of the first week of regular unemployment for states with no waiting period and extend UI benefits for an additional 13 weeks through December 31, 2020 after state UI benefits end.

- The proposed recovery rebates will use 2019 tax returns (2018 if the taxpayer has not filed in 2019) to determine the advanced rebate amount and reconcile the rebate based on 2020 income. This means that taxpayers who receive a smaller rebate than they are eligible for based on 2020 income will receive the difference after filing a 2020 tax return, but overpayments of rebates due to a higher income in 2020 will not be clawed back

- Employers are eligible for a 50 percent refundable payroll tax credit on wages paid up to $10,000 during the crisis. The credit would be available to employers whose businesses were disrupted due to virus shutdowns and those that had a decrease in gross receipts of 50 percent or more when compared to the same quarter last year. The credit can be claimed for employees who are retained but not currently working due to the crisis for firms with more than 100 employees, and for all employee wages for firms with 100 or fewer employees.

- Certain employer payments of student loans on behalf of employees are excluded from taxable income. Employers may contribute up to $5,250 annually toward student loans, and the payments would be excluded from an employee’s income.

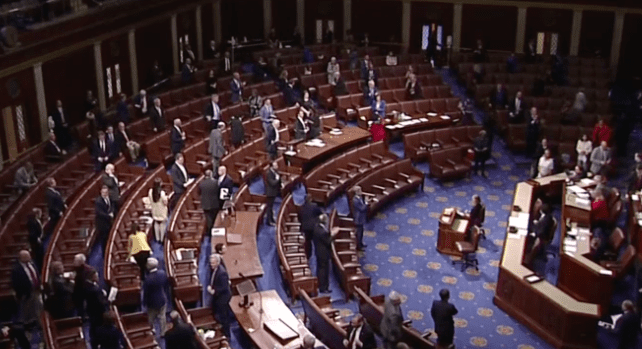

On Friday afternoon, the Coronavirus Aid, Relief and Economic Security (CARES) Act passed the House of Representatives by a voice vote. The bill now moves to the President for signature. The bill builds upon earlier versions of the CARES Act and is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, succeeding the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act. It is the product of negotiations between Democrats and Republicans for a bipartisan response to the crisis.

The CARES Act builds on the two former pieces of legislation by providing more robust support to both individuals and businesses, including changes to tax policy. The bill includes:

- Expanded unemployment insurance (UI) for workers, including a $600 per week increase in benefits for up to four months and federal funding of UI benefits provided to those not usually eligible for UI, such as the self-employed, independent contractors, and those with limited work history. The federal government is incentivizing states to repeal any “waiting week” provisions that prevent unemployed workers from getting benefits as soon as they are laid off by fully funding the first week of UI for states that suspend such waiting periods. Additionally, the federal government will fund an additional 13 weeks of unemployment benefits through December 31, 2020 after workers have run out of state unemployment benefits.

- $350 billion allocated for the Paycheck Protection Program, which is meant to help small businesses (fewer than 500 employees) impacted by the pandemic and economic downturn to make payroll and cover other expenses from February 15 to June 30. Notably, small businesses may take out loans up to $10 million—limited to a formula tied to payroll costs—and can cover employees making up to $100,000 per year. Loans may be forgiven if a firm uses the loan for payroll, interest payments on mortgages, rent, and utilities and would be reduced proportionally by any reduction in employees retained compared to the prior year and a 25 percent or greater reduction in employee compensation.

- Recovery Rebate for individual taxpayers. The bill would provide a $1,200 refundable tax credit for individuals ($2,400 for joint taxpayers). Additionally, taxpayers with children will receive a flat $500 for each child. The rebates would not be counted as taxable income for recipients, as the rebate is a credit against tax liability and is refundable for taxpayers with no tax liability to offset. The rebate phases out at $75,000 for singles, $112,500 for heads of household, and $150,000 for joint taxpayers at 5 percent per dollar of qualified income, or $50 per $1,000 earned. It phases out entirely at $99,000 for single taxpayers with no children and $198,000 for joint taxpayers with no children (see Chart 1). 2019 or 2018 tax returns will be used to calculate the rebate advanced to taxpayers, but taxpayers eligible for a larger rebate based on 2020 income will receive it in the 2020 tax season. Taxpayers with higher incomes in 2020 will see the overpayment associated with their rebate forgiven. For example, a single taxpayer with $100,000 in 2019 income would not receive an advance rebate but would receive the $1,200 credit on their 2020 return if their income for the year fell below the phaseout.

- On the other hand, a single taxpayer with $35,000 in income receives a $1,200 advance rebate but would not have to pay the rebate back on the 2020 return if they make $100,000 this year. This is structurally similar to the 2008 rebate design. We estimate the rebate will decrease federal revenue by about $301 billion in 2020, according to the Tax Foundation General Equilibrium Model. This credit is one-time, but policymakers may consider additional rebates if the downturn is prolonged.

We estimate that the rebates would increase taxpayer after-tax income by about 2.59 percent, ranging from 16.33 percent at the lowest quintile and dropping to 1.89 percent for the 80th to 90th percentiles. The rebate is structured progressively but is not available to those who have not filed taxes. These non-filers tend to have lower incomes. Additionally, Social Security Administration benefit information may be used for low-income taxpayers solely relying on Social Security benefits.

We estimate that nearly all filers below the 80th percentile will receive a rebate, but only 0.1 percent of filers above the 99th percentile will receive a rebate due to the rebate phaseouts. The average rebate will be about $1,523, ranging from $1,436 for the 0 to 20th percentiles to $45 for the 95th to 99th percentiles.

| Table 1. Conventional Distributional Effect of the Proposed Recovery Rebates (Revised) in the CARES Act | |||

| Income level | Percent Change in After-Tax Income | Average Rebate (Refundable and Non-Refundable Credit) | Share of Filers with a Rebate |

| 0% to 20% | 16.33% | $1,436 | 100% |

| 20% to 40% | 6.73% | $1,579 | 100% |

| 40% to 60% | 4.33% | $1,642 | 100% |

| 60% to 80% | 3.00% | $1,865 | 99.9% |

| 80% to 90% | 1.89% | $1,727 | 98.9% |

| 90% to 95% | 0.67% | $844 | 62.2% |

| 95% to 99% | 0.02% | $45 | 8.7% |

| 99% to 100% | 0.00% | $0 | 0.1% |

| Total | 2.59% | $1,523 | 93.6% |

| Source: Tax Foundation General Equilibrium Model, November 2019. |

- Creates a $300 partial above-the-line charitable contribution for filers taking the standard deduction and expands the limit on charitable contributions for itemizers.

- Waives the 10 percent early withdrawal penalty on retirement account distributions for taxpayers facing virus-related challenges. Withdrawn amounts are taxable over three years, but taxpayers can recontribute the withdrawn funds into their retirement accounts for three years without affecting retirement account caps. Eligible retirement accounts include individual retirement accounts (IRAs), 401Ks and other qualified trusts, certain deferred compensation plans, and qualified annuities. The bill also waives required minimum distribution rules for certain retirement plans in calendar year 2020.

- Certain employer payments of student loans on behalf of employees are excluded from taxable income. Employers may contribute up to $5,250 annually toward student loans, and the payments would be excluded from an employee’s income.

- A variety of business tax provisions:

- Employers are eligible for a 50 percent refundable payroll tax credit on wages paid up to $10,000 during the crisis. It would be available to employers whose businesses were disrupted due to virus-related shutdowns and firms experiencing a decrease in gross receipts of 50 percent or more when compared to the same quarter last year. The credit is available for employees retained but not currently working due to the crisis for firms with more than 100 employees, and for all employee wages for firms with 100 or fewer employees.

- Employer-side Social Security payroll tax payments may be delayed until January 1, 2021, with 50 percent owed on December 31, 2021 and the other half owed on December 31, 2022. The Social Security Trust Fund will be backfilled by general revenue in the interim period.

- Firms may take net operating losses (NOLs) earned in 2018, 2019, or 2020 and carry back those losses five years. The NOL limit of 80 percent of taxable income is also suspended, so firms may use NOLs they have to fully offset their taxable income. The bill also modifies loss limitations for non-corporate taxpayers, including rules governing excess farm losses, and makes a technical correction to the treatment of NOLs for the 2017 and 2018 tax years.

- Firms with tax credit carryforwards and previous alternative minimum tax (AMT) liability can claim larger refundable tax credits than they otherwise could.

- The net interest deduction limitation, which currently limits businesses’ ability to deduct interest paid on their tax returns to 30 percent of earnings before interest, tax, depreciation, and amortization (EBITDA), has been expanded to 50 percent of EBITDA for 2019 and 2020. This will help businesses increase liquidity if they have debt or must take on more debt during the crisis.

- Technical corrections to the depreciation treatment of qualified improvement property (QIP).

- The excise tax applied on alcohol used to produce hand sanitizer is temporarily suspended for tax year 2020.

- Aviation excise taxes are suspended until January 1, 2021. We estimate this will reduce federal revenue by about $8 billion in 2020.

- $454 billion in emergency lending to businesses, states, and cities through the U.S. Treasury’s Exchange Stabilization Fund. Additionally, this includes $25 billion in lending for airlines, $4 billion in lending for air cargo firms, and $17 billion in lending for firms deemed critical to U.S. national security. Firms taking loans must not engage in stock buybacks for the duration of the loan plus one year and must retain at least 90 percent of its employment level as of March 24, 2020. Loans also come with terms limiting employee compensation and severance pay for firms taking loans. Emergency lending will be overseen by a Congressional Oversight Commission and a Special Inspector General.

- Health provisions to address the coronavirus crisis, including provisions addressing supply shortages, coverage of diagnostic testing for the virus, support for health-care providers, improving telehealth service access and flexibility, encouragement for the creation of drugs to treat the virus, strengthening related Medicare and Medicaid provisions, and providing support for educational institutions.

- $150 billion in a Coronavirus Relief Fund for state and city government expenditures incurred due to dealing with the coronavirus public health emergency. The fund would be allocated by population proportions, with a minimum of $1.25 billion for each state.

- The Tax Foundation is the nation’s leading independent tax policy nonprofit. Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy at the federal, state, and global levels. For over 80 years, our goal has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.