Search Posts

Recent Posts

- Johnston secures federal funds for all 9 home buyouts on Belfield Drive with persistent flooding April 23, 2024

- ART! Celebrating 13 years of Art Connection RI – at Shri Yoga April 23, 2024

- Rhode Island Weather for April 23, 2024 – John Donnelly April 23, 2024

- New Budlong Pool: Cranston DPW sets public meeting on ways to recognize its history April 23, 2024

- May 1st RI State House event launches Mental Health Month programs. Awards, personal stories. April 22, 2024

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

State, Feds Withholding Millions from RI Cities and Towns

Federal Relief Funds shared to date by the State with R.I. Municipalities: $0.00 – but that’s not all…

Rhode Island is only one of three states not to provide financial assistance to local governments to combat COVID-19 and address its financial impacts, the R.I. League of Cities and Towns revealed today. Combined with other municipal budget challenges caused by the state and federal governments, property taxpayers across the state may be left to fill the multi-million-dollar gaps left by the “COVID Trifecta.” The Trifecta includes:

1. None of Rhode Island’s federal Coronavirus Relief Fund ($1.25 billion) has been allocated to local communities;

2. The State of Rhode Island is withholding millions in lump sum budget allocations required by state law; and,

3. Municipalities have been warned to expect long delays with Federal Emergency Management Agency (FEMA) reimbursements for COVID-19 disaster relief.

An August 3 study from the National League of Cities found that only Rhode Island, New York and New Jersey had not provided Federal emergency relief aid to local governments. Communities have already incurred expenses and await reimbursement from FEMA, which could take months or years. The Coronavirus Relief Fund (CRF) may be used to pay for some of those expenses and other costs not covered by FEMA.

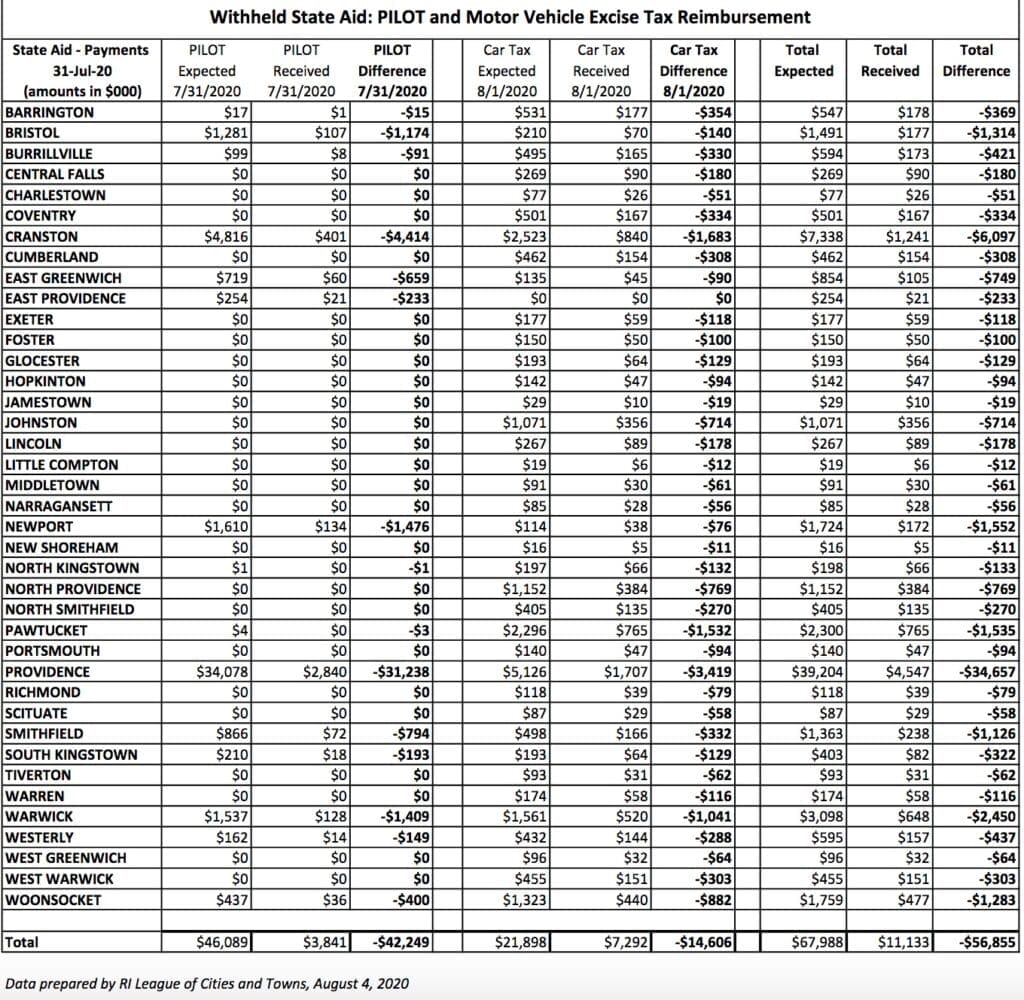

At the same time, the State is withholding $42.2 million in PILOT funding (Payment in Lieu of Taxes) to cities and towns. These payments are required by law to be paid in full on July 31stfor expenses incurred in the prior year, but the State announced late last Thursday, July 30, that it plans to make less than 10% of the payments. PILOT funds compensate municipalities for tax revenues that cities and towns do not collect from certain property owned by the State and health and education non-profits. Cities and towns plan their budgets around receiving full PILOT aid on July 31, which has been the practice for many years. The State is also reducing the expected August 1streimbursementfor the quarterly motor vehicle tax phase-out by $14.6 million.

“Delaying these state payments will lead to serious financial challenges for some communities,” said Central Falls Mayor and League President James Diossa. “Adding insult to injury, the State of Rhode has received $1.25 billion in Federal funds to address COVID-19, and cities and towns haven’t received a penny,” said Cranston Mayor Allan Fung. “Cities and towns have been working day and night to provide public safety services, enforce state guidelines and keep local government running, yet they have received none of Rhode Island’s $1.25 billion.”

“Now the State is withholding funds that communities were counting on,” he added. “It is unacceptable that cities and towns have been left to fend for themselves.” Cranston was set to receive $4.8 million in PILOT funds last week and $2.5 million in motor vehicle tax payments. Instead, it received only $1.2 million, or $6.1 million less than expected.

Since the State did not pass a budget before the start of the new fiscal year on July 1, cities and towns do not know how much aid local governments and schools can expect. Mayors and town managers have been tracking this issue for months and requesting updates from Governor’s Raimondo’s office on a regular basis in case alternative budget plans had to be made. School districts did receive education aid payments on time, but some state education funding formula payments were substituted with Federal funds. Now, communities are being required to apply for these Federal funds, instead of receiving them directly, causing further budget headaches.

“At the 11th hour, the State has reneged on its budget obligations,” said North Providence Mayor Charles Lombardi. “The State has received $1.25 billion dollars in stimulus funds from Congress and borrowed $300 million in emergency funds, and yet cities and towns have been left out of the equation. Rhode Island’s dual battles against COVID-19 and to avoid a painful fiscal crisis will be effective only if all levels of government work together.”

In Washington, D.C., Congress has been negotiating an additional stimulus package, but has not reached agreement and is currently in recess. U.S. Senate Republicans released the HEALS Act –a $1 trillion stimulus bill to address the impacts of COVID-19, which does not include any direct funding for cities and towns. However, the Senate bill allows states to use the Coronavirus Relief Fund (RI received $1.25 billion) for revenue replacement/deficit reduction at the state level only if it distributes 25% of relief funds to local governments. The House-passed the$3 trillion HEROES Act, which included $375 billion in payments to local governments.

“With successful efforts being made in other states via the strategic distribution of CRF funds, its critical need to strengthen local cities and towns has been recognized. With Rhode Island’s dependence on property tax and a job market grounded in the hospitality industry, this economic impact will lag and affect our recovery over the next two years,” said Andrew Nota, East Greenwich Town Manager.

Nota further stated, “This ‘COVID Trifecta’ will place an enormous burden on property taxpayers and needed services in the midst of a recession, if action doesn’t occur soon. The responsibility for Rhode Island’s mounting property tax burden rests squarely at the State House –and these actions will only make things more difficult moving forward.”

Rhode Island cities and towns have incurred millions of dollars in costs to fight COVID-19, such as public safety personnel, protective equipment and enforcement of state and local orders, while repositioning their city and town halls to continue to serve residents. Many communities are still incurring costs and will have to do so while the virus is still active. The Federal Emergency Management Agency (FEMA) has informed communities that local leaders can expect delays in reimbursements.