Search Posts

Recent Posts

- Detailing Manhattan: Christopher Gray’s Legacy – David Brussat April 26, 2024

- Business Beat: BankNewport supports Kids’ Zone at new Save The Bay Hamilton Family Aquarium April 26, 2024

- Rhode Island Weather for April 26, 2024 – John Donnelly April 26, 2024

- GriefSPEAK: Dread. Fear. Welcome relief. – Mari Nardolillo Dias April 26, 2024

- Outdoors in RI: big animals, tiny Ticks, huge Trout, Chepachet’s Harmony Railway, 2A – Jeff Gross April 26, 2024

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

RI Veterans: Did you know? 17 February 22 – John A. Cianci

by John A Cianci, Department Veterans Service Officer, Itlalian American War Veterans (ITAM)

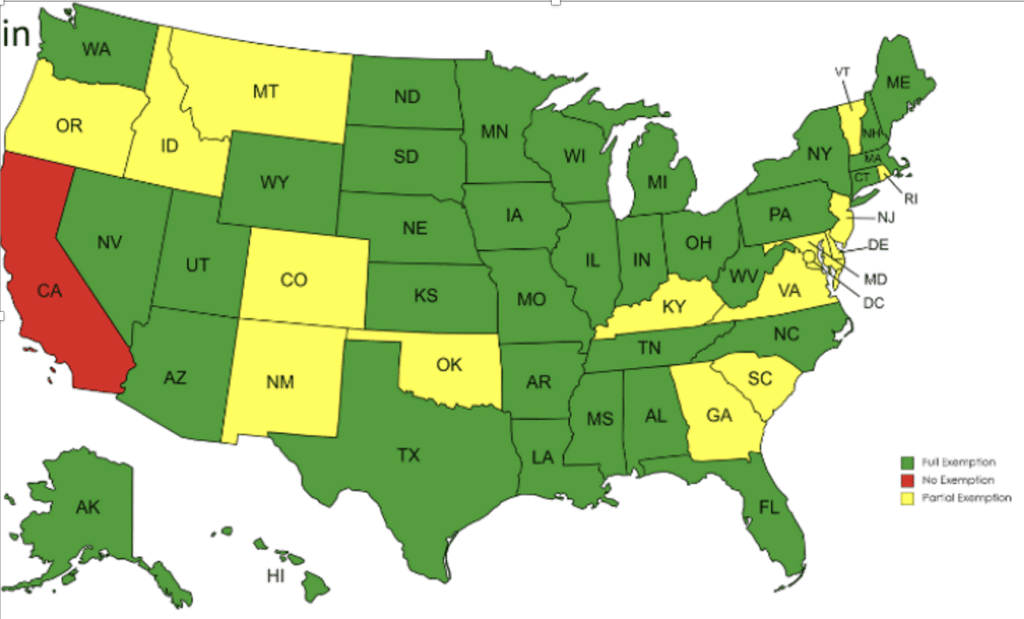

Did you know unlike our bordering states of Connecticut and Massachusetts, Rhode Island taxes military retirees pensions?

It’s time for the State of Rhode Island to tax exempt military pensions from state income taxes:

This should be a no-brainer since exempting generates more tax revenue

The light at the end of the tunnel appears closer for the estimated 5,222 military retirees residing in the State of Rhode Island who are required to pay taxes on their military retirement pensions, unlike retirees in Connecticut and Massachusetts which exempts military pensions from state income tax.

Governor Dan McKee, legislators, veterans, and supporters rallied at the state house and have testified before the House and Senate Finance Committees in support of the Governor’s FY budget proposal that would exempt military pensions from state income tax.

from the state’s income tax. Moreover, a budget was balanced despite introducing “reducing” state income tax being paid by military retirees.

During the Governor’s speech at one of the rallies that were held, Governor McKee said he had a conversation with Tony Dequattro, of Operation Stand Down Rhode Island. “He told me this has been a 40-year effort, I did remind him , how long have I been Governor doing the work.”

Last week RINEWSTODAY reviewed four veterans, retired officers who make over $100,000, and for each and every one savings from exempting their military pensions from taxes would be offset in sales tax and fuel tax they would pay to the State of Rhode Island from their increased disposable income. Let’s be clear, RINEWSTODAY analysis shows the State of Rhode would be having a positive tax revenue benefit by exempting military pensions.

Between the period of 2010-2020, VA statistics show veterans residing in the State of Rhode Island have decreased by almost 10, 000. Could the decline be intertwined with the state taxing military pensions? Could the decline in the State of Rhode Island ranking 47 out of 51 in the best places to live for military retirees be for the same reason?

RINEWSTODAY located a former Rhode Island, Master Sergeant Ralph Lataille, who relocated in 1993 to South Carolina a few years before his retirement from the U.S. Army. “Knowing my military pension was going to be taxed was one of the main reasons I chose to move to South Carolina,” said Lataille.” Sadly, in my home state, veterans do not consider Rhode Island to be a military retiree’s friend.”

at Beaufort County School

Lataille retired in his early forties from the military and although he would be receiving an estimated $27,000 military pension, he still needed to work and wanted to work. After retiring, Ralph began working as a School-to-Career professional for the Beaufort County School District while collecting his military retirement.

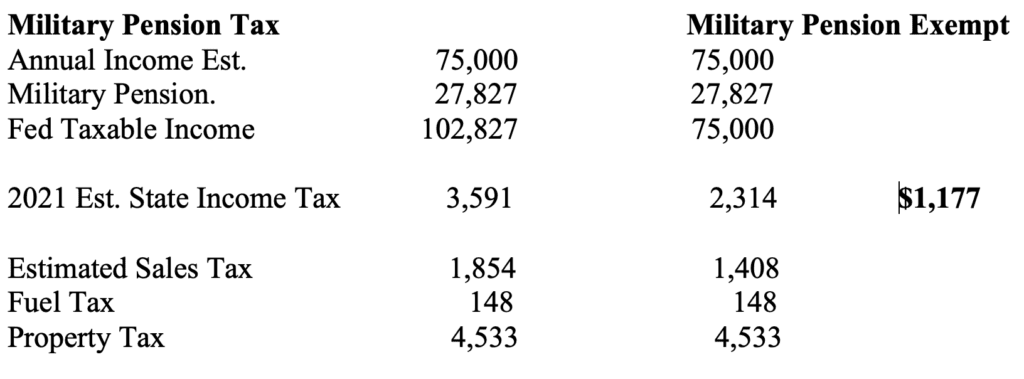

However, by choosing South Carolina , Lataille’s $27,000 military pension would be exempt from state income tax, saving $1,177 annually.

After relocating to South Caroline, Lataille continued to work and pay state income tax to South Carolina, instead of Rhode Island, an estimated $2,314. If he chose to remain in Rhode Island, state income tax would have been $3,591 annually, since Rhode Island would have taxed his $27,000 military pension.

Simply put, the state of Rhode Island lost $2,314 in income tax revenue for the $1,177 Lataille would have saved if military pensions were exempt from state income tax. In addition, Rhode Island lost an estimated $1,408 in Rhode Island in sales tax Lataille would have spent at local businesses; the $1,408 is more than $1,177 that Lataille would have paid in state income taxes because Rhode Island taxes military pensions.

Example – Military Retiree – Enlisted, estimated 3,500 of 5,222 retirees in Rhode Island

Retired Master Sergeant Ralph Lataille:

Relocated and retired to South Carolina 1993 – Born and raised in Rhode Island

Military pension estimated $27,827

Average taxable annual income from working since 1993, $75,000

Lataille’s parents also relocated to South Carolina following their son

According to a US Bureau of Labor Statistics press release, in September of 2021, if Lataille did not relocate to South Carolina, he would have paid an additional $4.681 in local property taxes and an additional $148 in fuel taxes.

“I’m pretty settled into South Carolina, however, I miss my friends and family in Rhode Island, and returning would be something I would consider if Rhode Island became more military-retiree friendly.” said Lataille, “Exempting military pensions from state income tax is a huge step forward.”

If Lataille was one of the 10,000 veterans that either left the state or died during the time period 2010 to 2020, the State of Rhode Island and local governments would add estimated $8,393 in tax revenue, for a small investment of an estimated $1,177 it would lose by exempting military pensions.

Annual Breakdown of Former Rhode Island Taxes

Lataille returns to Rhode Island from South Carolina and continues to work after passage of exemption of state income tax The State of RI gains:

$2,314 State Income Tax

$1,408 Sales Tax

$ 148 Fuel Tax

$4,533 Property Tax

$8,393 – TOTAL

Because Lataille relocated in 1993, state and local tax revenues have lost an estimated $153,000 since he relocated.

Let’s assume the 5,000 of 10,000 decline in veterans is intertwined with veterans choosing other states because of the taxing of their military pensions, Rhode Island loses an estimated $42 million a year due to military pensioners retiring and relocating due to the state income tax on military pensions.

Moreover, due to the decline in veterans, Rhode Island could lose allocating of funds for providing health care services at the Providence VA Medical facility.

Since Lataille retired a senior non-commissioned officer, more than likely his military pension represents the average the state has lost, estimated. His military pension is for life.

In South Carolina, veterans currently receive a partial tax exemption on their military benefits, which they receive if they have served at least 20 years. However, South Carolina and Georgia both have bills pending to fully exempt military pensions for military retirees. As of January 2022, 35 other states than North Carolina, Tennessee, and Florida have passed full exemptions, while Georgia, another partial-exemption state, is currently considering moving to a full exemption as well.

“ITS TIME” read the signs being held by veterans supportive of pending legislation exempting military pensions. Exempting military pensions from state income tax is a small payoff to those veterans who honorably served their country. It should be an investment in those who have earned it. A small price to pay to the gatekeepers of America’s freedom.

EVENTS

March 24, 2022, 2pm, Rhode island Veterans Home, Bristol, RI, women veterans and active-duty women are invited to the annual tea event which also will recognize Women’s Military History. All Military Active-Duty Women and Women Veterans are invited to the RI Veterans Home to honor and celebrate the annual tea. All services, all eras, all wars – please come and enjoy coffee, tea and refreshments. Recognize Women’s History Month by telling your stories or listen to stories of women who served in the Military and women who served their country in many ways, leaving a legacy of achievements.

RESOURCES

AARP offers a free career center for veterans, http://campaigns-aarp-org-stage.targetclose.com/veteran-job-center . The center offers a free course, Veterans Career Advantage, job search tool for companies seeking veteran employees, link to access what a good resume looks like, and other tips for veterans seeking employment.

DISCOUNTS

Restaurants

Applebee’s – Military Discount. With more than 2,000 locations, Applebee’s is a family grill restaurant. Applebee’s gives 10% off for active duty and veteran. Last verified 07/31/2021

Denny’s – Hartford Ave, Johnston offers 10% discount for veterans and active duty . Denny’s is a table service diner-style restaurant chain. Last verified 07/31/2021

Outback Steakhouse – 10% Discount to active and veterans. Last verified 07/28/2021

99 Restaurant & Pub – The 99 Restaurant & Pub offers a 10% military discount to members of Veterans Advantage. Available at select locations only. Bring valid military ID

Retailers

Advance Auto Parts – 10% for Active Duty, Veterans, and families. Last verified 07/28/2021

Bass Pro Shops – Offers a 5% discount to active-duty military, reservists, and National Guard. Sign up and verify your status online or bring your military ID when you shop at your nearest Bass Pro store (source).

BJs Wholesale – Reduced membership fee. BJ’s offers all military personnel over 25% off their Membership. Last verified 07/28/2021

Lowes – Enroll in the Lowe’s Military Discount Program to activate your 10% discount. “Our way of saying Thank You” to our active duty, retired and military veterans and their spouses with a 10% discount on eligible items.

Verification of your military status is fast and easy through our partner, ID.me. ID.me is our trusted technology partner in helping to keep your personal information safe.

GameStop – is offering a 10% in-store military discount on all pre-owned products, collectibles, and select new products. Available to current and former military members who bring any valid proof of service or when they verify through ID.me

Home Depot – Offers a 10% off military discount on regularly priced merchandise for in-store purchases for active duty, retired military, and reservists at participating locations. Customers are required to show a valid government-issued military ID card to redeem this offer.

Kohls – 15% discount offers for active military, veterans, retirees, and their immediate family members a 15% discount on purchases made on Mondays, in store only. In order to receive the military discount, eligible customers must present proper identification along with any tender type.

Jiffy Lube – HONORING VETERANS ALL DAY EVERY DAY! We didn’t want to wait for Veteran’s Day to express our appreciation and gratitude for your service. That’s why every Team Car Care owned and operated Jiffy Lube® service center is offering our BEST discount of 15% OFF as a “Thank You” to the men and women of our Armed Forces for their service to our country. *Disclaimer*- I.D. required. No coupon is required. Excludes batteries and brakes, alignment, and diagnostic services. Available only at select locations – Tioque Ave, Coventry RI – Bald Hill Road, Warwick RI – Park Ave, Cranston RI

Michaels – offers a 15% off military discount on the entire in-store purchase including sale items for active duty, retired military, guard, reservists, veterans, and family members. How to get –

1. Create an Account. Log in or create a Michaels Rewards account.

2. Get Verified. Provide your military information to get verified instantly.

3. Go Shopping! To use your discount online and in store, just sign into your account or provide your Michaels Rewards phone number at checkout.

O’Reilly Auto Parts – 10% discount on in store items for Active Duty, Veterans and families. Last verified 3/4/21.

_____

If you are a retailer and or a veteran aware of a business not listed above, please forward , [email protected]: the business’s name , location, and military and veteran discount offered.

If you have an event, meeting, other pertinent veteran information, or email questions or help needed, contact the Italian American War Veteran Service Officer, John A Cianci, [email protected], ITAM Office 1-(401)677-9VET(9838)

_____

To read all columns in this series go to: https://rinewstoday.com/john-a-cianci/

John A. Cianci is a Veteran Service Officer. Retired, U.S. Army MSgt., Persian Gulf War and Iraq War combat theater.

Cianci, a combat disabled Veteran, served in Desert Shield/Storm and Operation Iraqi Freedom. His awards include Bronze Star, Combat Action Badge, Good Conduct, and others.

Cianci belongs to numerous veterans organizations – Italian American War Veterans, American Legion, Veterans of Foreign War, United Veterans Council of Rhode Island, and many more organizations. He is an active volunteer assisting veterans to navigate federal and state benefits they have earned. He is Department of Rhode Island Department Commander Italian American War Veterans and Veteran Service Officer.

He is a graduate of Roger Williams University (BS Finance), UCONN business school* (Entrepreneur Bootcamp For Veterans), Solar Energy International Residential, Commercial and Battery Based Photovoltaic Systems certificate programs, numerous certificates from the Department of Defense renewable energy programs, including graduate of the Solar Ready Vets Program.

wow, I didn’t know Rhode island was taxing the vets on their retirement pension. you brought a lot of interesting points.

John Cianci’s data and conclusions are comparable to the study SENE MOAA started in 2015, and updates in 2019. Slightly different data points, but same overall conclusions. Glad to learn that an independent analysis validates my study.

John Cianci,

Thank you for posting such a great article to raise the level of awareness of the tax burden on retired RI veterans pensions!!!!!! Spot on! More revenue spent by veterans will generate revenue to the business community and will be recovered in generated sales tax!