Search Posts

Recent Posts

- In the News… quick recap of the week ending May 10, 2025 May 10, 2025

- Sally Lapides, Pres/CEO, Residential Prop. joins Federal Reserve Bank Business Advisory Council May 10, 2025

- Burn with Kearns: Cut fat, get strong, train like a fighter. White collar fight camp – Kevin Kearns May 10, 2025

- State Legislature may sink one of Rhode Island’s most successful industries – Nick Landekic May 10, 2025

- Rhode Island Weather for May 10, 2025 – Jack Donnelly May 10, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

State Legislature may sink one of Rhode Island’s most successful industries – Nick Landekic

by Nick Landekic, contributing writer – op-ed

It’s no secret that state budgets are under painfully increasing pressures with cuts in federal support and funding. Rhode Island is particularly at risk being the second largest per capita recipient of federal money, and a proposed state budget that naively assumes $5.1 billion – 36% of the total – will come from the federal government.

To expect the Trump administration will send Rhode Island over $5 billion is untethered from reality. It’s no surprise our state legislators are frantically looking for new sources of revenues – meaning, new taxes. In the process they may destroy one of our largest and most successful industries.

The legislature is currently considering H.B. 6256, a proposal to reinstate both the sales tax and ongoing property tax on boats in Rhode Island, reversing a wise decision in 1993 for exemption. This is important for everyone even if you don’t have a boat. Let’s take a closer look why.

Because Rhode Island’s industrial base was declining state leaders in 1993 astutely decided to create a tax exemption to spur the growth of the marine industry.

It was wildly successful.

The marine economy in Rhode Island now has 2,435 businesses and employs 41,174 employees, and generates $2.65 billion in annual sales. The marine industry accounts for $1.3 billion in wages and contributes $3.3 billion to the state’s GDP.

Many premier boat builders located here, along with dozens of successful marinas and hundreds of related businesses including boatyards, repair services, marine supply stores, even restaurants and bars. Boaters who keep their boats in Rhode Island also patronize and spend money in local stores and on fuel.

The only reason there are so many boats and related business in Rhode Island is the favorable tax treatment. All of this would be jeopardized by a boat sales or property tax, risking the loss of tens of thousands of jobs and billions of dollars of economic impact from boaters spending on marine and related goods and services.

Reinstating the sales and property tax would likely result in many of the boats and related businesses leaving Rhode Island. Remove the favorable tax treatment and there would remain no compelling reasons why marine business and sales should take place in Rhode Island rather than Massachusetts or Connecticut. You need to give businesses a reason to be here, and that reason has been favorable tax treatment.

Reinstating a sales and property tax on boats will probably not raise significant revenues. Boat sales are already declining because of economic anxiety caused by Donald Trump’s damaging and irrational actions. Reinstating a tax will only further decrease them, and any illusory revenues some think could be realized.

Commercial fishermen and others who rely on the water for their livelihoods, already struggling with increased costs, would be hurt by an annual property tax. How many would be forced out of business? Everyday Rhode Islanders who enjoy boating might have to give it up – and stop spending money and contributing to the state economy – if an annual property tax is added to already high expenses.

The lost jobs, lost income tax from all those employees, sales taxes from sales of marine goods and services related to boats, and lost jobs, revenues, and taxes from all the many associated restaurants and other businesses would dwarf any minimal revenues that might be realized from a sales and property tax.

The hard truth is Rhode Island is economically weak with few natural resources, few major businesses, and few nationally recognized universities. Rhode Island ranks dead last among the 50 states for attractiveness to start a business. The state’s performance across many measures is dismal: the worst public health record of all states in managing the pandemic (per capita), the worst road conditions of all states, the highest proportion of structurally unsound bridges, and the highest proportion of its population of all New England states relying on Medicaid benefits. One of the few bright spots in the state economy is the marine industry.

Our legislature will not be able to tax its way out of our financial predicament. The issue is not insufficient tax revenues. The unpleasant reality is grossly inefficient spending due to the state’s endemic and ingrained graft, corruption and waste.

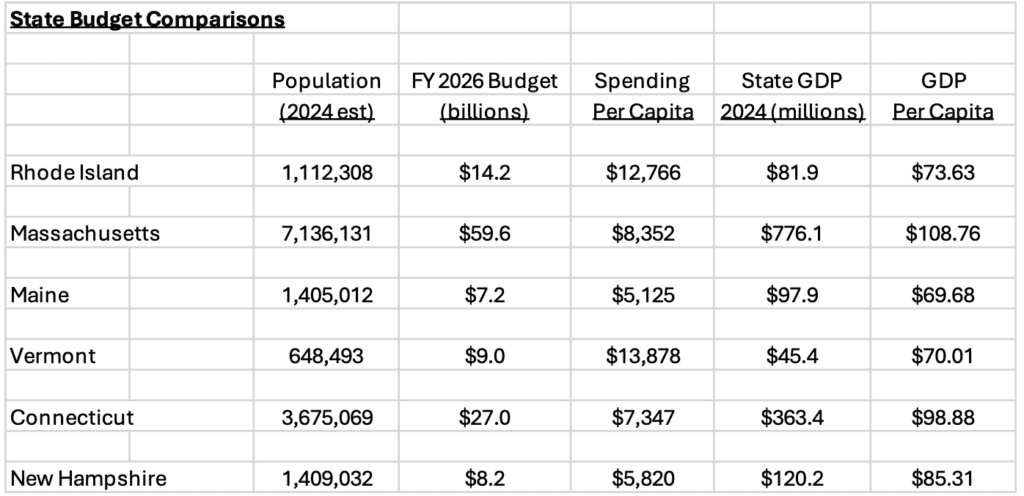

Per capita Rhode Island spends about 50% more than Massachusetts yet has a state GDP that is about 50% less than Massachusetts. We spend more per capita than many other states yet have less to show for it and with greater needs and problems. The reason is because much of the money gets wasted in Rhode Island, on graft, personal pet projects, inflated no-bid contracts, unnecessary spending, and corruption.

If Rhode Island’s per capita state spending was closer to that of Massachusetts or Connecticut the total state budget would be about $9 billion – and, importantly, would not rely on federal subsidies and would not require any increases in taxes. Learning from Massachusetts and other states could improve our quality of life while at the same time spending less money – if the money were to be used more efficiently.

In 2019 Governor Gina Raimondo achieved a balanced state budget with a total spend of about $9 billion. This laudable achievement is what our legislators must work towards getting back to.

In many cases a sales tax on boats could be justified – but not in Rhode Island. Reinstating a boat sales and property tax here will not accomplish what is needed and will painfully backfire and have the opposite effect. ‘Soaking the rich’ makes for pithy sound bites and may attract some votes – until thousands of people start losing their jobs.

Changing Rhode Island’s culture will take time but is the only way the state will survive the new reality of the Trump administration. In the meantime our legislators should objectively look at the facts. Passing H.B.6256 will only increase unemployment, cause businesses and people to leave the state, decrease net state tax receipts, and decimate the marine industry and destroy one of the most successful business segments in the state.

If you have any feelings on this write to your state representatives and let them know. If they’re not part of the solution, then they’re part of the problem.

—————-

Nick Landekic of Bristol is a retired C.E.O. and biotechnology entrepreneur who has spent more than 35 years working in the pharmaceutical industry.

right on. what is the state’s projected deficit? why do we consifer new taxes before we have data on the projected deficit?