Search Posts

Recent Posts

- U.S. Carries Out Limited Strike on Iran’s Known Nuclear Sites (Updates) June 22, 2025

- A Greener View: E. Coli vs. Vegetables, and Your Garden – Jeff Rugg June 22, 2025

- Rhode Island Weather for June 22, 2025 – Jack Donnelly June 22, 2025

- Ask Chef Walter: The Art and Science of Baking – Chef Walter Potenza June 22, 2025

- Gimme’ Shelter: Aurora is waiting for a home at the Providence Animal Control Center June 22, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

RIPEC: RI state budget transitions from unprecedented revenues to fiscal restraint

RIPEC Analyzes Key Issues as Rhode Island’s State Budget Tightens – Health and Human Services, K-12 Education, Transportation, and Affordable Housing Highlighted as Challenges

The Rhode Island Public Expenditure Council released a report examining the state’s fiscal outlook ahead of the FY 2025 budget process. Over the past few years, Rhode Island’s state budgets have had an infusion of unprecedented revenues fueled by massive federal pandemic relief funding and record state revenue surplus dollars. However, the abundant allocations of federal funding are now expiring, and the state’s general revenues are growing at a much slower rate.

“Rhode Island’s state budget stands at a major transition point, leaving a time of unprecedented revenues and entering a period of fiscal restraint,” said Michael DiBiase, President and CEO of RIPEC. “The challenge for the governor and General Assembly will be managing spending expectations set when the state was flush with money, while also needing to tackle serious policy needs in vital areas which include healthcare, education, transportation, and housing. The needs and expectations in these areas versus the available resources are going to create budgetary pressures.”

The FY 2024 enacted budget reflects the continuation of a level of total spending dramatically higher than before the pandemic.

- At $14.01 billion, total expenditures for FY 2024 are $4.44 billion (46.3 percent) greater than for FY 2019, the last year unaffected by the pandemic.

- Largely due to pandemic relief funds, expenditures from federal sources jumped from $3.21 billion in FY 2019 to $5.64 billion in FY 2024.

- State general revenue spending of $5.43 billion in the enacted FY 2024 budget represents a $1.44 billion (37.4 percent) increase over FY 2019.

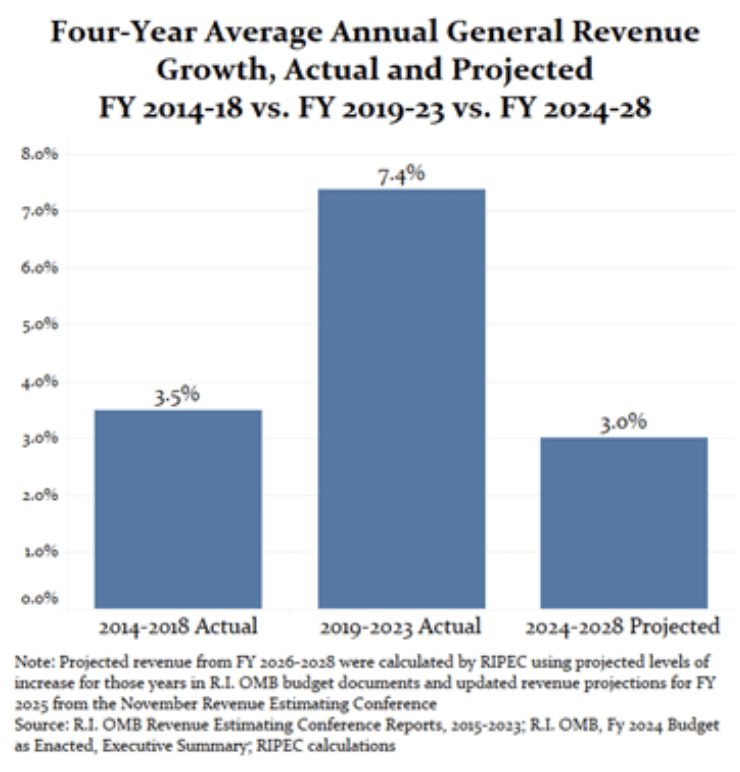

With federal funds expiring and expected revenues shrinking, the state is moving toward a period requiring more fiscal restraint and more closely resembling the pre-pandemic era of budgeting. As shown in the figure below, based on state estimates, the average annual growth rate for general revenue for FY 2024 through FY 2028 is 3.0 percent—less than half the 7.4 percent annual average of the preceding four-year period (FY 2019-FY 2023) and slightly lower than the 3.5 percent annual average before the pandemic (FY 2014-FY 2018).

Representing 37.6 percent of total general revenue spending in the FY 2024 budget, health and human services is the single largest and fastest-growing component of the state budget and has grown dramatically over the past five years due in significant part to federal pandemic relief funding. Medicaid spending—which makes up 70.8 percent of total expenditures for health and human services—largely drove the increase in state general revenue spending in this area. RIPEC reported that general revenue expenditures on Medicaid increased by 44.7 percent between FY 2019 and FY 2024, significantly above the 37.4 percent growth rate of general revenue spending overall.

“Despite this large jump in state spending on Medicaid, there is considerable pressure to increase provider rates, which would further increase Medicaid costs,” said Michael DiBiase. “With Medicaid taking up approximately 30 percent of the entire general revenue budget for FY 2024, significant broad-based increases in Medicaid rates would not appear to be affordable absent major changes to the health delivery system.”

Pushed by inflationary factors in the school funding formula and hold harmless policies protecting school districts from losses in state aid due to declining enrollments, state general revenue spending on K-12 education has increased by $309.2 million (26 percent) since FY 2019. Driven largely by a massive infusion of federal ESSER funds, total spending on K-12 education increased at an even higher rate (40.8 percent) over the same five-year period, even while student enrollments declined (by 3.6 percent).

“Federal pandemic funding and hold harmless policies have insulated many districts from difficult decisions related to their declining enrollments,” said DiBiase. “With federal ESSER funds set to expire in September 2024 and with the Assembly unlikely to continue to fully fund empty seats, many districts may have to reduce staff and classrooms to match the reality of their student populations. Given the dramatic shifts in our education system, it is high time to reform the education funding formula.”

Transportation finance in Rhode Island is challenged by declining revenues at a time when there is a need for greater state resources to match large projected federal funding increases. The largest source of revenue for transportation, the state gas tax, is producing declining revenues despite planned rate increases. The state’s truck toll program, which produced nearly $40.0 million in annual revenue when fully implemented in FY 2022, was declared unconstitutional by the U.S. District Court and has been suspended pending the state’s appeal. If the ruling is sustained, this funding gap will need to be filled. Moreover, serious fiscal problems at RIPTA, which is forecasting a $33 million deficit for FY 2025, places additional pressure on transportation finances.

Finally, Rhode Island faces significant housing affordability challenges. With nearly one-third of all households statewide paying more than 30 percent of their income on rent or mortgage, it is estimated that Rhode Island needs 24,000 more affordable units to meet demand. The General Assembly has capitalized on federal pandemic relief aid by allocating $422.1 million to affordable housing largely from one-time federal funds ($361.2 million for production) over the past three years, but once federal funds are expended, there are no current plans for additional state funding for affordable housing outside of a modest Housing Production Fund, a new state low-income housing tax credit, and possible additional borrowing in the form of a $100 million proposed bond issue requested by the Department of Housing.

“Despite historic investments, the current rate of return on state investment will leave us far short of our affordable housing goals. The cost of developing one affordable unit of housing is approaching $500,000, and RIPEC’s analysis shows that the state is picking up an increasing share of the burden. Our projections show that the state’s recent and historically large allocation will produce only about 2,340 units, or roughly 10 percent of the state’s estimated need,” DiBiase added.

RIPEC makes the following recommendations for consideration based on its findings:

Given the constrained revenue outlook for FY 2025 and beyond, the state needs to avoid spending commitments beyond available resources and prepare to curtail spending growth.

In this more constrained environment, policymakers should focus not only on rejecting spending increases but also streamlining programs and improving returns on investments.

Policymakers should be strategic in increasing provider Medicaid reimbursement rates.

Policymakers should pursue comprehensive reform of the school funding formula with the objective of targeting more aid to urban core districts. The funding formula needs reform to better support students in poverty and multilingual learners, and to assist urban core districts facing the most serious fiscal challenges.

Policymakers should develop a sustainable finance plan for transportation.

The state should develop a plan to devote greater resources to affordable housing but also explore more efficient models to produce new affordable units. Land use reform also should be pursued to increase supply and stabilize home prices and rents.

A full copy of the report is available here.

Editor’s Note: Challenges to infrastructure such as flood preparedness, roads, and bridges, are extraordinary needs in Rhode Island and will continue to press the Rhode Island budget beyond its planning. The Governor’ State of the State address is this Tuesday, January 16th.

To take one small example: “serious fiscal problems at RIPTA, which is forecasting a $33 million deficit .”

Good grief, look at the huge buses — empty! — rolling up and down the roads. There are many routes and schedules that need streamlining. Just can’t do this for the fare that one or two persons provide on a run.

And I love the RIPTA bus parked on the side of the road, running, early in the morning, while the driver runs into the gas station convenience store to get his snacks. Is that part of his job?

The revenue projections are deceptive. The bar chart appears to project a 3% increase from 2024 – 2028. But that is actually a 4 year AVERAGE. The cumulative revenue increase by 2028 will be over 12%, but this number is omitted from the analysis.

Meanwhile, the cost of restoring the pension COLA is ALWAYS presented in cumulative format, making its affordability appear to be unreachable. In reality, the COLA increase would only track parallel with the revenue increase, making it extremely affordable.

The state budget increased by approximately 85% in the last 12-13 years. During that same period, with the freeze on retiree COLAs, the state has, by its own reported figures, saved more than $4 Billion Dollars by freezing retiree pensions at 2012 levels. However, as part of the RIRSA 2011 law of 2011, teachers must work approximately 10 additional years maybe more, at the very top pay scales. The plus side is more money goes to the state pension fund through teacher contributions at 11.25% of gross salary. The minus side is two-fold. The school districts also contribute to the pension fund, increasing the cost of education since teachers stay longer by law before retiring, and the state passed the 2011 legislation saying it was ‘saving the pension fund’ when in fact it was doing nothing of the kind. It was, instead generating $4 Billion in revenue to use for pet projects and causes of the politicians. Repeal of the 2011 Raimondo-sponsored legislation would lower education costs and create jobs for younger teachers who are not at the top steps of the pay scale. There’s a break even point in this conundrum but no one seems to want to find it. They seem far more interested pointing accusational fingers than working to a rational solution. And it appears, similar problems exist in the other areas mentioned in this article. The #1 interest in our General Assembly membership is getting re-elected, not solving the problems that need to be addressed.