Search Posts

Recent Posts

- Rose Island experts Sean O’Connor and Michael Simpson – G. Wayne Miller, Ocean State Stories June 11, 2025

- Time for Sour Grapes! – 6.11.25 – Tim Jones June 11, 2025

- Rhode Island Weather for June 11, 2025 – Jack Donnelly June 11, 2025

- What you should know about Social Security if your spouse passes away – Cheryl Tudino, SSA June 11, 2025

- It is what it is… 6.11.25 – Jen Brien June 11, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

RI Veterans: Did you know? 18.01.24 (Taxes, position vacancy, events, resources, discounts) – John A. Cianci

by John A. Cianci, contributing writer

Question from one of our readers:

Is VA disability income taxable? – Stan, Burrillville RI

VA disability benefits you receive from the Department of Veterans Affairs aren’t taxable.

Disability benefits received from the VA should not be included in your gross income. Some of the payments which are considered disability benefits include:

- Disability compensation and pension payments for disabilities paid either to Veterans or their families,

- Grants for homes designed for wheelchair living,

- Grants for motor vehicles for Veterans who lost their sight or the use of their limbs, or

- Benefits under a dependent-care assistance program.

This includes the following:

- Disability Compensation: A monthly tax-free benefit given to veterans who have disabilities due to illnesses or injuries incurred in or aggravated during military service

- Dependency and Indemnity Compensation (DIC): Tax-free benefits for survivors of military members who died on active duty or from a service-connected disability

- Special Monthly Compensation: A higher tax-free benefit for veterans with very severe disabilities or who face particular circumstances such as the need for aid and attendance (A&A)

You don’t need to include them as income on your tax return. Tax-free disability benefits include: Disability compensation and pension payments for disabilities paid either to veterans or their families.

Do I get a 1099 for my VA disability?

No, you will not receive a 1099 form for your social security disability benefits. So you do not have to report your VA disability income on your tax return. As we mentioned earlier, they are not taxable, so you will not need to fill out a 1099 or pay taxes on them.

Veteran Real Estate Tax Credit

March 15th is the most common deadline for a veteran to apply at his or her town hall for the real estate tax credit worth hundreds, if not thousands of dollars off the veteran’s real estate tax.

Sadly, too many veterans are not receiving the Rhode Island real estate tax credit annually by his or her town or city.

Just last week, 3 Rhode Island Veterans and a widow all who own a home told me they do not get a real estate tax credit from the town or city they live in.

One had applied several years ago but was told “she wasn’t a veteran.”

The others were unaware they were eligible for a tax credit that could save them hundreds, if not thousands of dollars annually.

Last year, the Italian American War Veterans of US assisted 58 veterans and 8 widows to apply and receive approval from their hometown or city to receive the veteran tax credit.

Since they applied last year, they no longer have to apply, since the application is a one-time process tax credit

Most of the veterans who do not receive the veteran real estate credit didn’t consider themselves a veteran, since they never served in a war.

To clarify, definition for veteran for the Veteran Real Estate tax credit is:

1. The veteran or deceased veteran served and received an honorable discharge, which is supported by discharge papers; normally DD214 is the veteran’s discharge papers.

Simply put. If you served in the U.S. Armed Forces from 1947, and were honorably discharged, under Rhode Island law you are entitled to an annual tax credit from your town or city if you own a house.

VETTIP – Rhode Island law classifies any person who has an honorable discharge served in the Armed Forces since 1947 as a veteran. If you present your DD214 and the town or city representative refuses to accept your application for the tax exemption, saying “you are not a veteran or eligible”, contact your local State of Rhode Island Senator or State Representative.

How do I get the credit?

To be eligible for this credit, the veteran must bring his or her DD214/discharge papers to the city or town hall and apply for the veteran tax credit. The credit will result in an average savings for veterans from $100 to $500 dollars, annually, on real estate taxes.

What is my town or city’s deadline to apply for the credit?

Most towns and cities have a March 15, 2023 deadline to apply for the credit to ensure the credit will be reflected on the upcoming real estate tax bill. Once approved, the veteran does not need to apply again, and if the veteran passes on, the widow or widower would be eligible for the same credit as long as he or she remains unmarried.

How do I find out my town or city’s deadline?

Option 1 – The veteran could go to the town or city website to search for the veteran real estate tax credit deadline .

Option 2 – Call the town tax department.

VETIP: I would go to town or city hall with my discharge papers, DD214. Even if the deadline passed, I would fill. Out the application since it could be used for application for the following years.

For more information on the amount of tax credit and the deadline for your town or city for veterans, disabled veterans, go to Governor Daniel J McKee’s September 2022, Report on the Veteran, Senior, and Other Tax Exemption Report:

In conclusion, any veteran or spouse of deceased veteran who applies and told not eligible, contact the Italian American War Veterans of US, (401) 677-9838, or email itamri4vets@gmail.com A member of our team will contact the town and or city hall to advise them they are breaking the law.

VETTIP: Recommend you have the name of a city or town employee who denied your application and or told you “you are not a veteran.”

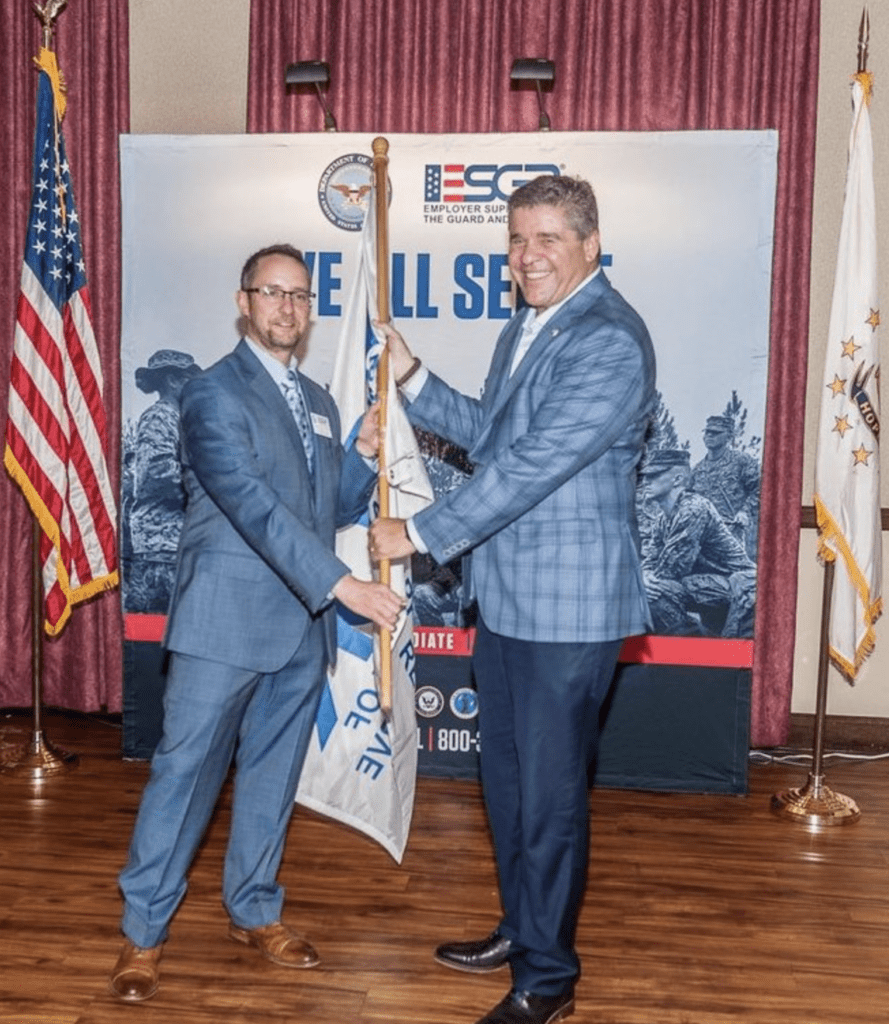

Job Vacancy: ESGR Chairmanship

From a Facebook posting, outgoing Chairmanship, Ernie Almonte of the Rhode Island Employer Support of the Guard and Reserve term is ending September 30, 2024. Please consider applying for this position and/or sharing this request as wide as possible. “A great position for an outstanding organization,” Almonte posted.

Employer Support of the Guard and Reserve Seeks Nominations for Rhode Island ESGR State Chair

The Rhode Island Committee of the Employer Support of the Guard and Reserve announces the launch of their formal search for the next Rhode Island ESGR State Chair. The State Chair is an official Department of Defense volunteer position with a three-year term of service. State Chairs are required to take an oath of office and serve at the pleasure of the ESGR National Chair. The Rhode Island State Chair’s role is to provide the leadership and vision for a team of dedicated volunteers throughout Rhode Island to conduct the ESGR mission.

ESGR is a Department of Defense program that develops and promotes supportive work environments for service members in the Reserve Components through outreach, recognition, and educational opportunities that increase awareness of applicable laws.

ESGR carries out its mission through its headquarters staff and more than 3,700 volunteers across 54 State Committees who conduct proactive outreach to Service members and employers to make them aware of their rights and responsibilities under the Uniformed Service Employment and Reemployment Rights Act (USERRA); provide no-cost, neutral mediation to Service members and their employers when issues arise; and manage a robust Employer Awards program to recognize the critical role supportive employers have in enhancing retention rates in the Reserve Component (RC).

Proven leaders, who are interested and meet qualifying skills for the Rhode Island ESGR State Chair position, are encouraged to submit a nomination.

To be considered for selection, each interested candidate should submit a nomination package, to include the following items:

1. Biographical summary or resume

2. A letter stating his/her reason(s) for interest in serving, and thoughts and plans for leading the insert state ESGR state committee.

3. Other supporting materials, as appropriate (recommendations, photos, etc.)

Nomination packages must be submitted via U.S. mail no later than February 15, 2024, to the Rhode Island ESGR Search Committee Chair at the following address: Rhode Island ESGR c/o Veronica Castro, 705 New London Avenue, Cranston, RI 02920 Questions about the process may be referred to the Search Committee Chair through, Veronica Castro at email: veroinica.castro25.ctr@army.mil. For additional information about ESGR, visit www.ESGR.mil.

___

EVENTS

January 15, 2024 11:30am – FREE LUNCHEON for all veterans and their guest at VFW, 134 Shove Street, Tiverton, RI from 1130 am to 1300pm. This month meal will be chicken parmigiana, pasta, Caesar salad, and dessert. Sponsored by Building Bridges, Italian American War Veterans of US, VFW Tiverton RI, and Front Line Ministry for Freedom, Bristol RI.

January 20, 11AM-2PM – VFW 2024 Educational Awards Luncheon, Quonset O’ Club, 200 LT. JAMES BROWN RD. NORTH KINGSTOWN RI , 435 per person, $280 / 8 per table. Buffet Style, all welcome . Point of Contact GINAMARIE DOHERTY 401-500-1721 email: yncsgrd@aol.com. Checks can be sent to VFWRI HQ, One Capitol Hill, Providence RI 02908. The Veterans of Foreign Wars Department of Rhode Island would like to announce this Fiscal Year’s 2023-2024 Educational & Awards Luncheon. This year’s event will be promoting the following programs:

· Patriots Pen Scholarship available for grades 6th-8th.

· Voice of Democracy Scholarship is available for grades 9th-12th.

· Teacher of the Year Award for any teacher from the grades K-12th.

February 19, 2024 – FREE LUNCHEON for all veterans and their guest at VFW, 134 Shove Street, Tiverton RI from 1130 am to 1300pm. This month meal will be chicken parmigiana, pasta, Caesar salad, and dessert. Sponsored by Building Bridges, Italian American War Veterans of US, VFW Tiverton RI, and Front Line Ministry for Freedom, Bristol RI.

___

Travel/Entertainment for Veterans

Free Golf, Goddard Park Golf Course Fee Exemption for Totally Disabled Veterans: Rhode Island resident Veterans who have a 100% permanent and total, service-connected disability rating from the VA are exempt from paying any fees to play golf at the Goddard Park Golf Course. For more information year-round at Division Headquarters at 401-667-6200.

Free Rhode Island Hunting and Fishing Licenses for 100% Disabled Veterans: A Veteran who has a 100% disability rating from the VA is eligible for free Rhode Island hunting and fishing licenses.

No cost licenses are available if you are:

· over 65 AND a Rhode Island resident

· a veteran with 100% disability status from the Department of Veterans Affairs

· a person with 100% total disability status from the Social Security Administration

To apply in person at DEM, please bring a photo ID and an ORIGINAL DOCUMENT OF THE FINAL DECISION(S). Office hours are 8:30 a.m. to 3:30 p.m. Monday through Friday. (directions)

To apply by mail, please complete an application and mail the application and a copy of your photo ID and the ORIGINAL DOCUMENT OF THE FINAL DECISION(S). Please allow two weeks for processing.

The address to obtain your license in person or by mail is:

DEM Licensing Office

235 Promenade Street, Room 360

Providence, RI 02908

(401) 222-3576

To purchase online, you will be required to certify that you have an ORIGINAL DOCUMENT OF THE FINAL DECISION(S). You will also be required to enter the date the decision expires. The Department will audit compliance with the certification and may, at any time, request a copy of the current DOCUMENT OF THE FINAL DECISION(S). Failure to submit the documentation by the date requested may result in the suspension of your fishing and hunting license. Also, Rhode Island General Law 11-18-1 prohibits giving false documents to an agent, employee, or public official. The penalty is a misdemeanor punishable by a fine of up to $1,000 or imprisonment up to one year.

Rhode Island Hunting and Fishing Benefits for Service Members and Veterans: Rhode Island offers several hunting and fishing benefits to Service members and Veterans. A short description of each is listed below. Applicants are required to show documentation proving eligibility when they apply:

· Active-Duty Service members – Military ID

· Veterans – DD214

· Disabled Veterans – VA Disability Certification Letter ( Contact VA office)

Applicants can apply online at Rhode Island Outdoors, in person at the Rhode Island Department of Environmental Management, Office of Boating Registration and Licenses in Providence (Monday through Friday 8:30 a.m. – 3:30 p.m.), at an Authorized In-Person Sales Agent, or they can mail applications to:

Rhode Island Department of Environmental Management

235 Promenade Street, Room 360

Providence, RI 02908

Phone: 401-222-3576

Free Rhode Island State Park Passes for 100% Disabled Veterans: Rhode Island offers the State Park Disability Pass for use at any state-owned recreational facility to disabled Veterans who have a 100% service-connected disability rating from the VA.

The State Park Disability Pass authorizes free admission and parking but does not exempt the following:

· Licensing fees

· Camping fees

· Picnic table fees

· Specialized facility use fees

· Use of equestrian areas

· Performing art centers

· Game fields fees

· Mule shed fees

If the disabled Veteran cannot drive, the vehicle transporting the Veteran will not be charged.

Veterans must apply in person at the Rhode Island State Parks and Recreation Headquarters and are required to show official documentation (dated within the past year) from the VA that states they have a 100% service-connected disability.

Rhode Island State Parks and Recreation Headquarters

1100 Tower Hill Road

North Kingstown, RI 02852

Phone: 401-667-6200

Email: dem.riparks@dem.ri.gov

___

Resources & ongoing groups

Below are all the groups the Providence Vet Center is currently offering. As this list changes, I will provide updates. Please send me any questions that you may have, thank you for your time!

***All Vet Center Groups require that the Veteran be enrolled with the Vet Center prior to attending. To check eligibility or for questions, please contact the Vet Center at (401) 739-0167 or reach out to our Veteran Outreach Program Specialist (VOPS) via email at Justyn.Charon@va.gov***

Post-Traumatic Stress Disorder Group (PTSD) – 2nd and 4th Tuesday of the month from 2:00 – 3:30 p.m. (Group is only active September through May)

Global War on Terrorism (GWOT) and Vietnam Veterans PTSD Group – 2nd and 4th Wednesday of the month from 9:30 – 11:00 a.m.

Vietnam Veteran PTSD Group – 1st and 3rd Monday of the month from 10:30 – 12:00 p.m. and 5:30 p.m. – 7:00 p.m.

Art Expression Group – Every Thursday from 9:00 – 12:00 p.m.

Operation Enduring Freedom (OEF)/Operation Iraqi Freedom (OIF)/Operation New Dawn (OND) Group – Every Wednesday from 11:00 – 12:00 p.m.

Stress Management – Every Thursday from 9:00 – 10:00 a.m.

Low Impact Walking Group – Every Tuesday from 9:00 – 10:00 a.m.

Guitar 4 Veterans – Every Wednesday from 7:00-8:30 p.m.

Monday Mindfulness Group – Every Monday from 10:00 – 11:00 a.m.

Yoga Group – Every Friday from 12:00 – 1:00 p.m.

Moral Injury Group – Every Friday from 10:00 – 11:00 a.m.

Modern Warrior Support Group – 1st and 3rd Monday of the month from 2:30 – 4:00 pm.

___

Discount Offers

Services

No Problem Plumbing and Heating LLC: 15% military discount, ask for Ron Gaynor, (401) 568-6666. Veterans must provide proof of eligibility with a VA Card, VA ID Card, or RI State license with veteran identification.

Restaurants

Applebee’s – Military Discount. With more than 2,000 locations, Applebee’s is a family grill restaurant. Applebee’s gives 10% off for active duty and veteran. Last verified 07/31/2022.

Denny’s – Hartford Ave, Johnston offers 10% discount for veterans and active duty. Denny’s is a table service diner-style restaurant chain. Last verified 07/31/2022.

Outback Steakhouse – 10% Discount to active and veterans. Last verified 07/28/2021

99 Restaurant & Pub – The 99 Restaurant & Pub offers a 10% military discount to members of Veterans Advantage. Available at select locations only. Bring valid military ID

Retailers

Advance Auto Parts – 10% for Active Duty, Veterans, and families. Last verified 07/28/2021

Bass Pro Shops – Offers a 5% discount to active-duty military, reservists, and National Guard. Sign up and verify your status online or bring your military ID when you shop at your nearest Bass Pro store (source).

BJs Wholesale – Reduced membership fee. BJ’s offers all military personnel over 25% off their Membership. Last verified 07/28/2021

Lowes – Enroll in the Lowe’s Military Discount Program to activate your 10% discount – “Our way of saying Thank You” to our active duty, retired and military veterans and their spouses with a 10% discount on eligible items. Verification of your military status is fast and easy through our partner, ID.me.

ID.me is our trusted technology partner in helping to keep your personal information safe.

GameStop – is offering a 10% in-store military discount on all pre-owned products, collectibles, and select new products. Available to current and former military members who bring any valid proof of service or when they verify through ID.me

Home Depot – Offers a 10% off military discount on regularly priced merchandise for in-store purchases for active duty, retired military, and reservists at participating locations. Customers are required to show a valid government-issued military ID card to redeem this offer.

Kohls – 15% discount offers for active military, veterans, retirees, and their immediate family members a 15% discount on purchases made on Mondays, in store only. In order to receive the military discount, eligible customers must present proper identification along with any tender type.

Jiffy Lube – HONORING VETERANS ALL DAY EVERY DAY! – We didn’t want to wait for Veteran’s Day to express our appreciation and gratitude for your service. That’s why every Team Car Care owned and operated Jiffy Lube® service center is offering our BEST discount of 10% OFF as a “Thank You” to the men and women of our Armed Forces for their service to our country. *Disclaimer*- I.D. required. No coupon is required. Excludes batteries and brakes, alignment, and diagnostic services. Available only at 3 select locations: Tioque Ave, Coventry RI – Bald Hill Road, Warwick RI – Park Ave, Cranston RI

Michaels – offers a 15% off military discount on the entire in-store purchase including sale items for active duty, retired military, guard, reservists, veterans, and family members. How to get –

1. Create an Account. Log in or create a Michaels Rewards account.

2. Get Verified. Provide your military information to get verified instantly.

3. Go Shopping! To use your discount online and in store, just sign into your account or provide your Michaels Rewards phone number at checkout.

O’Reilly Auto Parts – 10% discount on in store items for Active Duty, Veterans and families. Last verified 3/4/21.

___

If you are a retailer and or a veteran aware of a business not listed above, please forward to: itamri4vets@gmail.com: the business’s name, location, and military and veteran discount offered.

If you have an event, meeting, other pertinent veteran information, or email questions or help needed, contact the Italian American War Veteran Service Officer, John A Cianci, itamri4vets@gmail.com, ITAM Office 1-(401)677-9VET(9838)

___

To read all columns in this series go to: https://rinewstoday.com/john-a-cianci/

John A. Cianci is a Veteran Service Officer. Retired, U.S. Army MSgt., Persian Gulf War and Iraq War combat theater.

Cianci, a combat disabled Veteran, served in Desert Shield/Storm and Operation Iraqi Freedom. His awards include Bronze Star, Combat Action Badge, Good Conduct, and others.

Cianci belongs to numerous veterans organizations – Italian American War Veterans, American Legion, Veterans of Foreign War, and many more organizations. He is an active volunteer assisting veterans to navigate federal and state benefits they have earned. He is Department of Rhode Island Department Commander Italian American War Veterans and Veteran Service Officer.

He is a graduate of Roger Williams University (BS Finance), UCONN business school* (Entrepreneur Bootcamp for Veterans), Solar Energy International Residential, Commercial and Battery Based Photovoltaic Systems certificate programs, numerous certificates from the Department of Defense renewable energy programs, including graduate of the Solar Ready Vets Program.