Search Posts

Recent Posts

- Writer Herb Weiss’ 45 years of Advocacy on Aging now Archived at Rhode Island College Library Special Collection June 23, 2025

- Providence Biopharma, Ocean Biomedical, Notified of Termination of License Agreements with Brown University, RI Hospital June 23, 2025

- Networking Pick of the Week: Early Birds at the East Bay Chamber, Warren, RI June 23, 2025

- Business Monday: Dealing with Black and White Thinking – Mary T. O’Sullivan June 23, 2025

- Rhode Island Weather for June 23, 2025 – Jack Donnelly June 23, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

Lawrence Insurance Agency has you covered

A Lincoln-based, veteran-owned insurance company wants current and potential clients to understand why they may be paying too much for their personal and/or business coverage. Often times, it has less to do with the companies that service their insurers and more to do with where they reside.

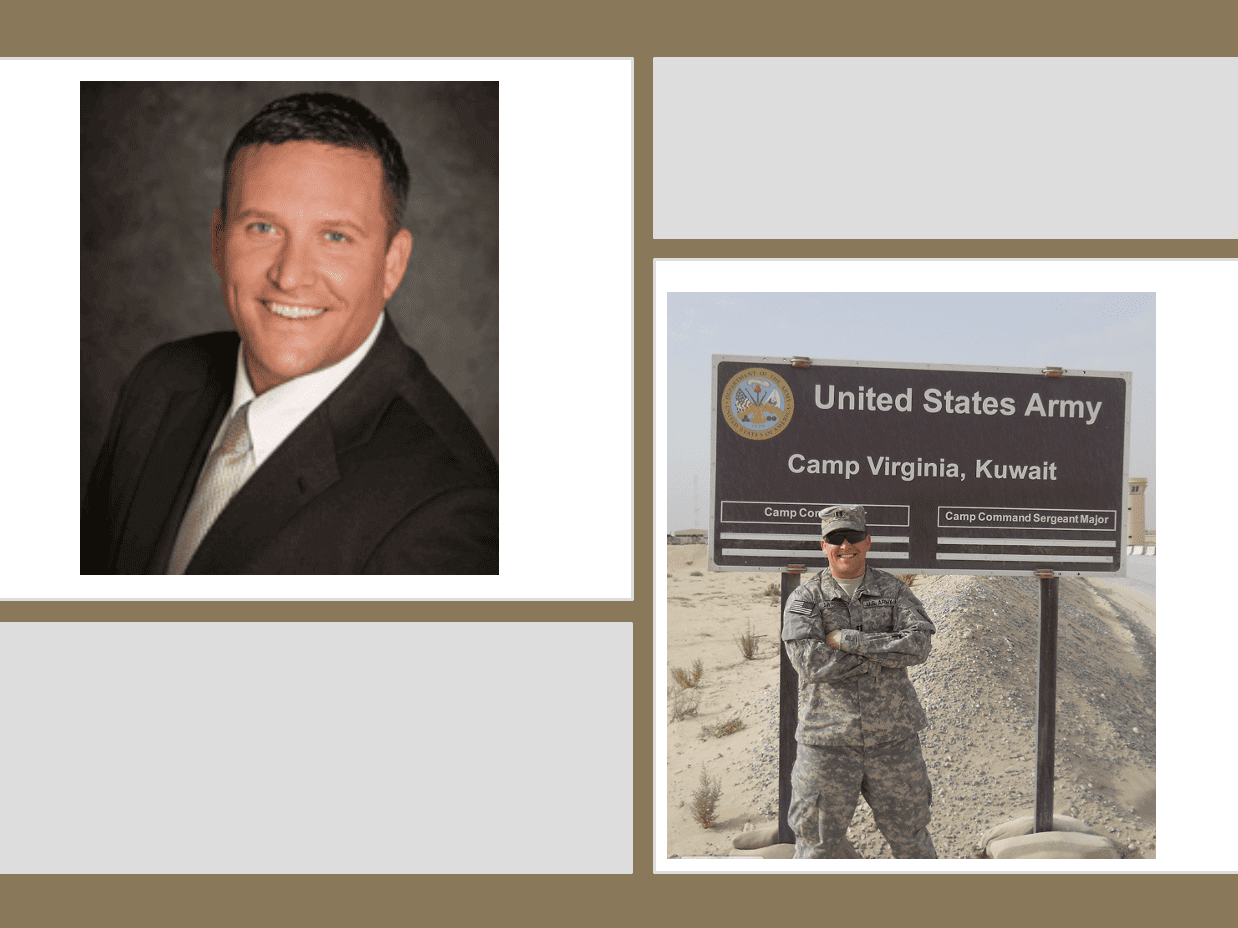

Peter Lawrence, owner of Lawrence Insurance Agency, says this state and even this region are contributing factors regarding why insurance rates continue soaring and why it makes sense to check your policies more often.

“I have been in this business for a long time and personally witnessed what some companies have done to either reject claims or skimp on services and/or parts for damaged vehicles to put more money on their own coffers,” said Lawrence, who began his company on March 1, 2008, after a stint in the U.S. Army, achieving the rank of Major. “There is a lot of insurance fraud in this state between personal injury suites and repair shops that openly advertise to have the deductible taken care of. All of the people’s rates increase when claims are submitted and processed.”

So, it honestly doesn’t surprise him when someone in the state is paying between $1,500 and $1,800 per year on an auto policy with full coverage and higher liability limits. Other parts of the country may pay as little as one-third of that annually because of where they live (weather and population density) and the lower number of fraudulent claims.

“The state minimum auto insurance requirement is 25/50/25,” he continues. “That means $25K per person for bodily injury, up to $50K per accident and $25K for property damage. Those limits don’t go too far in an at-fault accident in today’s economy. The rest is out of pocket.”

The agency is a full-service venture that tackles both personal and commercial clients.

On the personal side, they ranges from valuables like jewelry and homes to cars and art or collectibles. Lawrence works with multiple carries such as The Hartford, Liberty Mutual, Nationwide (where Peter began his career after the Army in 2008) and several other carriers to not only provide the best rates, but the right coverage as well.

Having the freedom to shop around gives customers more options on quotes, and reviewing numbers from four companies instead of just one carrier makes good business sense and assures what will work best from the client’s standpoint.

A list of valuables could include expensive “toys” such as motorcycles, boats, snowmobiles and other recreational vehicles and activities. Lawrence says many people are misinformed when it comes to properly insuring that classification, especially during the off months or when you are away from your driveway. “Some people falsely believe they can eliminate the coverage once the season ends. Your registration will get suspended for more than a 30-day lapse in coverage. Instead of lowering their coverage between the winter months when they aren’t using those items, and then flipping back in the spring, they can save on the hassles of re-registering their activity vehicles and the additional money that comes with opening up a new policy,” he said.

The agency’s five-person staff works on developing sources for all lines of insurance, including commercial liability worker’s compensation, employee benefits and more. Lawrence sees his company’s philosophy being full service and able to handle most situations and needs.

Restaurants are of particular importance to him. They have been hit hard by the pandemic. Some have been devastated. They offer a product to help insulate business owners from further financial loss. “There are too many scenarios that can turn a reputable company into one that turns upside down,” Lawrence said. He works with each client to ensure they have the correct answers and choices to mitigate unwanted or unforeseen circumstances.

“When an insurance claim gets submitted, there are chances for something to fall through the cracks. We assist with setting up and following up on your claim to make sure you get a world-class experience and, most importantly, you are made as whole as possible again,” he said.

Looking forward to 2022, Lawrence said he would love to connect with small business owners—especially new owners—who want to discuss their insurance options. He reviews each policy to make sure the customer knows what they are paying for and are insured for what they genuinely need.

He does the same for property owners, be it homeowners, condos, multifamily rental, those owning vacation homes, or anyone who may be dissatisfied with their current insurance provider. It’s time to reassess those reconstruction values, and this is a perfect time to review.

The Lawrence Insurance Agency is located on 872 Smithfield Ave., in Lincoln. They are open Monday through Friday from 8:30 AM until 5:00 PM, Saturday by appointment, and closed on Sunday.

For more details about the agency or to schedule a free, no obligation consultation, please contact Peter Lawrence at 401-726-3210 or email him at peter@lawrenceagencyinc.com.

Further details may be found by visiting their website at www.lawrenceagencyinc.com.