Search Posts

Recent Posts

- Lifelong Learning Collaborative’s summer courses in arts, current affairs, literature, fitness and fun May 4, 2024

- Good for YOU: Try fishing – Free Freshwater Fishing this weekend May 4, 2024

- Rhode Island Foundation fellowships enable 3 local composers to focus on their music May 4, 2024

- In the news… summary on May 4, 2024 May 4, 2024

- Rhode Island Weekend Weather for May 4/5, 2024 – John Donnelly May 4, 2024

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

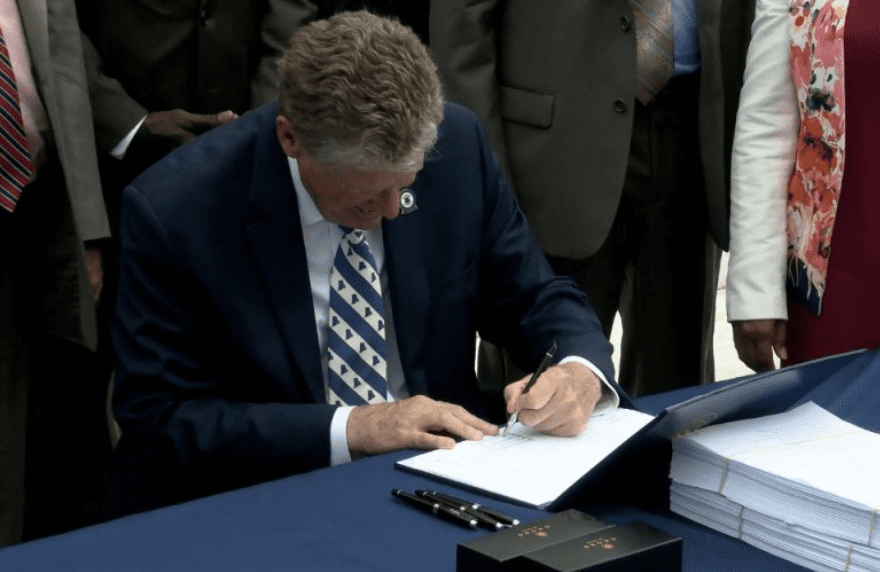

Gov. McKee signing bills into law…budget highlights

Governor Dan McKee signed the bills listed below into law this past week.

On Monday at 11am at the RI State House, the Governor will be signing a pair of bills focused on gun safety. The first bill will ban “straw purchases” of firearms. The second bill will prohibit anyone, with certain exceptions, from bringing a gun onto school property in Rhode Island.

| Bill number – Title H5760A – An Act Relating to Agriculture and Forestry S0470A – An Act Relating to Agriculture and Forestry H5131A – An Act Relating to Food and Drugs – Single-Use Plastic Straws S0155A – An Act Relating to Food and Drugs – Single-Use Plastic Straws H5571A – An Act Relating to Criminal Offenses – Children S0263B – An Act Relating to Criminal Offenses – Children S0684A – An Act Relating to Cities and Towns S0473aa – An Act Relating to Cities and Towns S0232A – An Act Relating to Professions – Physical Therapists S0076Aaa – An Act Relating to Education – The Civic Literacy Act S0484A – An Act Relating to Human Services – Medical Assistance – Perinatal Doula Services S0718A – An Act Relating to Property – Residential Landlord and Tenant Act S0413Aaa – An Act Relating to Businesses and Professions – Real Estate Brokers and Salespersons H5370Aaa – An Act Relating to Businesses and Professions – Confidentiality of Health Care Communications and Information Act S0062Aaa – An Act Relating to Businesses and Professions – Confidentiality of Health Care Communications and Information Act S0261A – An Act Relating to State Affairs and Government – Open Meetings H6433 – An Act Relating to State Affairs and Government – Open Meetings S0087A – An Act Relating to Education – Certified Nurse Teacher H5197A – An Act Relating to Education – Certified Nurse Teacher H6433 – An Act Relating to State Affairs and Government – Open Meetings S0792 – An Act Relating to Taxation – Levy and Assessment of Local Taxes H6157 – An Act Relating to Taxation – Levy and Assessment of Local Taxes |

| Governor McKee also vetoed S501B and H5505A. The Governor’s veto messages can be read here. |

Governor signs Budget

The FY22 budget was signed on July 6th. The Governor says the “budget makes important investments in housing, increases supports for families and child care, and provides the tools necessary to continue Rhode Island’s economic recovery. The $13.1 billion budget pays back all of the $120 million borrowed from the state’s rainy day fund at the early part of the pandemic and continues the phase-out of the car tax. This budget does not include any broad-based tax increases.”

Highlights of the budget include:

Historic investments in affordable housing: Before COVID-19, Rhode Island was facing a housing crisis – the pandemic has only exacerbated this issue for many families across our state. To help address this crisis, the budget creates the first permanent funding stream for affordable housing in Rhode Island’s history. The new funding is expected to generate approximately $4 million each year for the creation of affordable housing. The budget creates a Deputy Secretary of Commerce and Housing, who will oversee housing initiatives and develop a housing plan. The budget also allocates $6 million to establish a funding stream for a pay-for-success supportive housing initiative for those experiencing homelessness.

Support to sustain Rhode Island’s COVID?19 response and recovery: Rhode Island has led the nation in its vaccine rollout, surpassing the President’s goal of partially vaccinating 70 percent of adults by July 4. The budget includes a net increase of $107.8 million in federal funds and restricted receipts to sustain the state’s strong COVID-19 response. This includes funds to support vaccinations, testing, contact tracing, public health communications and data analytics. The budget also includes funding to support the Pandemic Recovery Office. Investments in our COVID-19 response allowed us to reopen our economy, get Rhode Islanders back to work and get our students safely back in the classroom this fall.

Continues economic development programs: The budget extends the sunsets on Commerce RI’s economic development programs including the Qualified Jobs Tax Credit Program, the Rebuild Rhode Island Tax Credit Program, the Wavemaker Fellowship and Innovation Voucher program. The budget also provides additional funding for the Small Business Assistance Program – Rhode Island’s first state backed small business loan program.

Investing in student success: This budget fully funds state aid to education and includes $7.7 million to fund the Rhode Island Promise program, which provides two years of free tuition at the Community College of Rhode Island to Rhode Islanders graduating high school. The budget also restores funding to the Paul V. Sherlock Center on Disabilities, which provides services to the state’s blind and visually-impaired students. The budget allocates $400,000 to cover the cost of AP Exams for students with financial need.

Funding to support child care providers: Child care is an important economic driver for families and our local economy. Rhode Island’s child care providers played a crucial role in the state’s COVID-19 response and will be key to our economic recovery. The budget delivers $3.6 million in federal funds to raise reimbursement rates to subsidized child care providers and over $400,000 to cap parents’ copays at 7 percent of income. Additionally, it extends the emergency rate being paid to providers during the pandemic for the next six months.

Support for low-income families: The economic impact of COVID-19 had a disproportionate impact on low-income families across the state. For the first time in 30 years, the budget includes $4.3 million for a 30-percent benefit increase for Rhode Island Works, the state’s cash assistance and work-readiness program for low-income families. This long overdue investment represents Rhode Island’s commitment to lifting families up and ensuring our economic recovery reaches everyone.

Supports for the Department of Children Youth and Families (DCYF): This budget provides much-needed funding to address heavy caseloads and greater population needs at DCYF. Funding includes the authorization for 85 additional employees and the authority to raise the DCYF Director salary to attract a qualified candidate for the vacant position.

Long Term Services and Supports resiliency: This budget makes vital investments in home- and community-based services to rebalance Rhode Island’s long-term care options. This includes rate increases for assisted and shared living, increasing the amount of personal income individuals may retain while receiving services, and providing additional pay for direct care workers that work off-hours or are trained in behavioral healthcare.

Protecting utility consumers and ensuring accountability: For years, Governor McKee fought for consumers by advocating for the Utility Service Restoration Act, legislation which establishes a concrete set of performance standards with corresponding penalties to hold utility companies accountable and protect families and small businesses in the case of an emergency. The Act, included in this year’s budget, is a proven measure that delivers real results for consumers in nearby states with all fines being credited back to ratepayers. In Massachusetts, similar legislation allowed the state to recover tens of millions of dollars in fines from utility companies for insufficient performance. This budget finally holds utility companies to a higher standard in Rhode Island and ensures local ratepayers receive the benefits.

Investments in a Statewide Body Worn Camera Program: The budget takes an important step forward in strengthening trust, accountability, and transparency between law enforcement and the people they protect and serve. It provides $15 million over 5 years for the Statewide Body Worn Camera Program which seeks to equip approximately 1,700 of Rhode Island’s uniformed patrol officers — across every police department and the Rhode Island State Police — with body-worn cameras over the next 12-18 months.

Crucial steps toward criminal justice reform: The budget prioritizes criminal justice reform, taking a responsible approach to reforming parole/probation and expanding opportunities for incarcerated individuals after they serve their time. The reform offers parole eligibility after 20 years of incarceration to all young people given lengthy sentences for crimes committed before age 22. It also establishes an innovative re-entry partnership between the Department of Corrections and the Department of Labor and Training to connect incarcerated individuals with post-release employment opportunities.

Protecting the Ocean State’s natural resources: Our state parks and beaches are some of Rhode Island’s most treasured places, providing countless families with opportunities to enjoy being outside. Rhode Island’s parks, beaches, and campgrounds attract over 9 million visits a year, infusing more than $310 million into the economy. The budget makes investments in the much-needed modernization of our state parks system, grounds maintenance, as well as building maintenance and repairs and to ensure that we can take better care of our natural resources.

Modernization of government: Modernized administrative systems are crucial to efficient government operations. The budget invests $50 million in the Information Technology Investment Fund to modernize the State’s human resources, payroll, and financial management information technology systems.