Search Posts

Recent Posts

- Dr. Rosemary Costigan Named President of Community College of Rhode Island June 19, 2025

- RI Veterans: Did you know? 19.06.25 (Military Funerals, Job Fair, Benefits, Events) – John A. Cianci June 19, 2025

- East Providence First in U.S. to Equip All Firefighters with PFAS-free Gear June 19, 2025

- We Cook! Mill’s Tavern Saffron Bouillabaisse with Tarhana Lobster Jus June 19, 2025

- Rhode Island Weather for June 19, 2025 – Jack Donnelly June 19, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

Employee’s Retirement System of Rhode Island had limited exposure to failing banks’ actions

On Monday evening, Rhode Island General Treasurer James A. Diossa released the following statement in response to Silicon Valley Bank (SVB) being placed under the receivership of the Federal Deposit Insurance Corporation.

“The financial challenges Silicon Valley Bank faced were unique to its structure and management,” said Treasurer Diossa. “Rhode Island’s exposure has been limited. The Employee’s Retirement System of Rhode Island has invested in a stock index fund that held some assets in SVB. Additionally, the retirement system has a limited amount of fixed income exposure to SVB within two externally managed portfolios. As of the end of February, assets invested in SVB totaled less than 0.016% of our total portfolio, reaffirming our state’s principle of broad diversification and partnering with financial managers that seek the highest levels of financial security.”

On Sunday, Signature Bank was added to failed banks. Other trading and investment banks and services were limited throughout the day.

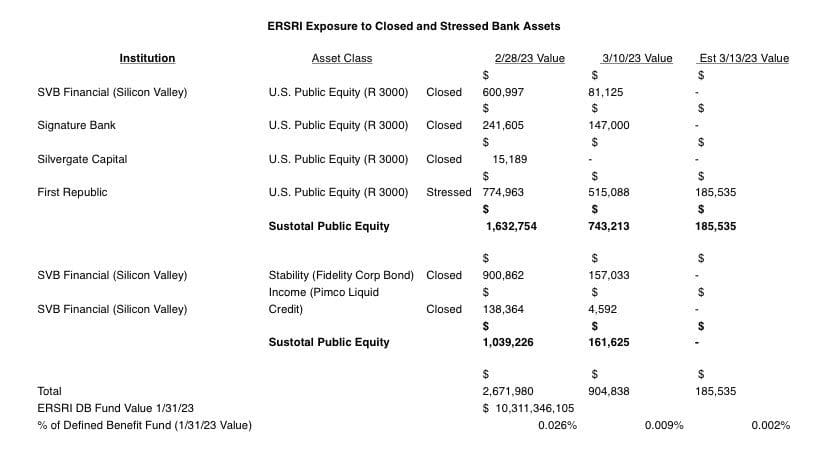

Michelle Moreno-Silva, Director of Communications for the RI General Treasurer, released this statement and chart, below:

ERSRI has had exposure to most of these assets for number of years as part of the Russell 3000 index in the U.S. public equity area. Additionally, there is some fixed income exposure within portfolios managed by Fidelity and PIMCO as part of the “Stability” and “Income” asset segments. The total exposure at the end of February represented less than 3 basis points of the total DB plan. We’re assuming that there is little value to the assets with the exception of First Republic which is still trading. Financial experts also commented that this provides more control over a banking system by the federal government.

President Biden made a brief statement and left the room without taking reporters’ questions. He assured all depositors that they would be insured even over the $250,000. But that investor groups who had taken a chance would lost their money and employees at failed banks would be terminated as the FDIC takes control. The government action to guarantee all deposits over $250,000 would presumably now extend to all deposits in all banks in the US. After the last banking crisis, the government acknowledged that it would never again cover deposits over the $250K amount, and this move to do so is widely seen as a bailout.

Companies such as ETSY, VIMEO, ROKU, Shopify and others were for a time without access to their funds until they were restored on Monday morning.

Emergency meetings on Sunday nights and a presidential address originally set for 8am on a Monday morning “before the stock market opened” perhaps added to the feeling of crisis over a situation well known to federal regulators for months. This situation was also seen as potentially influencing additional rate hikes, with continual hikes over the last year actually contributing to the failure being experienced now.

Buyers will now get in line to buy the troubled banks – with HSBC in the UK already purchasing the UK-based subsidiary of SBT for $1.

In addition to SVB, Signature Bank and First Republic are involved, with other smaller regional banks expected to follow.

The importance of regional banks protects the American consumer and businesses from the monopoly, of sorts, of four major banks in the US – JPMorgan Chase, Bank of America, Wells Fargo, and Citibank, and their subsidiaries – creating what some say would be the talked about government-controlled banking system. Investors may feel that only with the largest, and most regulated banks and institutions, is their money safe.