Search Posts

Recent Posts

- Real Estate in RI: Seaside waterfront communities are all the rage. Who’s buying – Emilio DiSpirito June 6, 2025

- Outdoors in RI: 2A votes, Charter Yachts, active summer programs, garden tours, aquatic weeds… June 6, 2025

- All About Home Care, with two Rhode Island locations, closing after 22 years in business June 6, 2025

- GriefSPEAK: Angel wings with footprints – Mari Nardolillo Dias June 6, 2025

- Rhode Island Weather for June 6, 2025 – Jack Donnelly June 6, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

AARP Rhode Island pushes its 2024 legislative agenda – Herb Weiss

by Herb Weiss, contributing writer on issues of aging

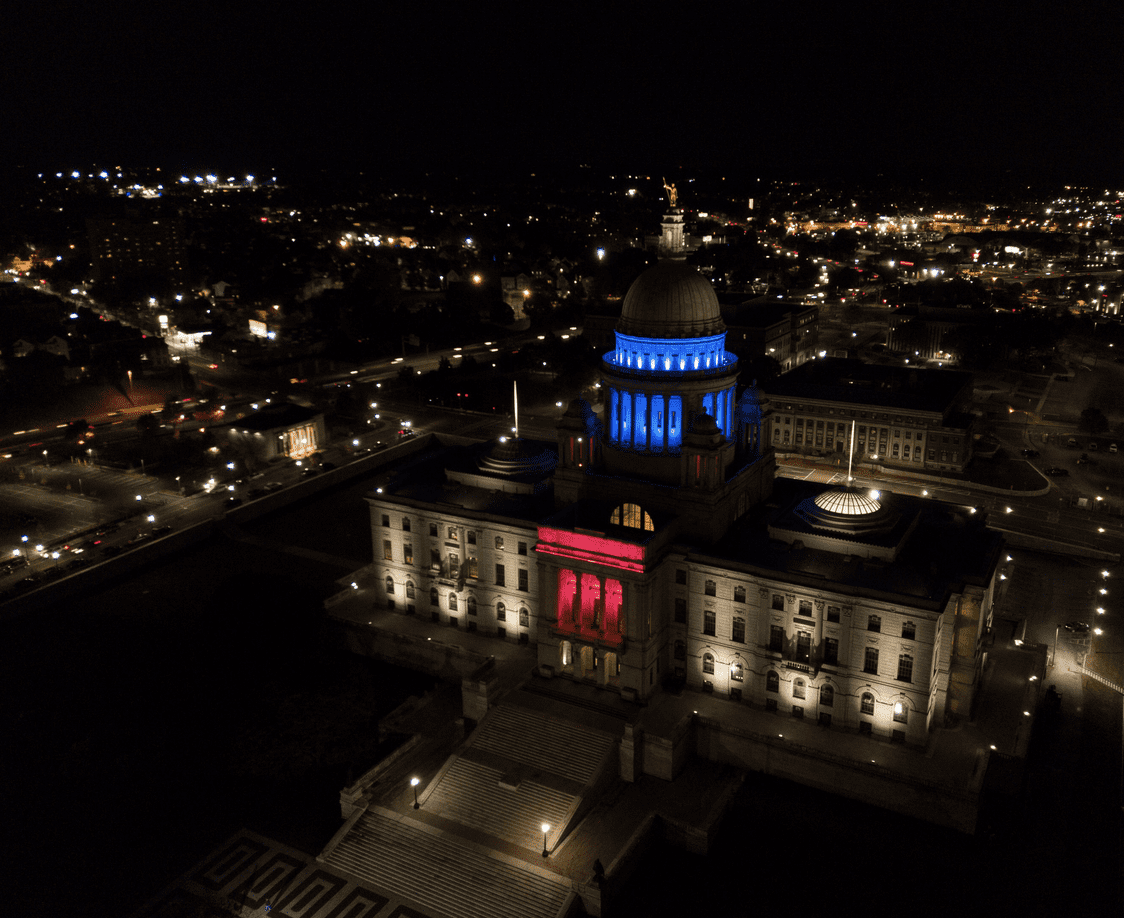

Photo: Pamela Bhatia, Artistic Images RI

Standing in front of an AARP backdrop in the Rhode Island State Room at the State House, last week AARP Rhode Island hosted a 34 plus minute press conference plugging the “aging” group’s 2024 legislative agenda. The nonprofit organization, representing 125,000 members, unveiled its four priority issues: to increase temporary care giver insurance to caregivers, to boost the availability of Accessory Dwelling Units (ADUs); to create a program to allow employees to save for retirement; and to eliminate the state’s income tax on Social Security.

Gov. Dan McKee, House Speaker K. Joseph Shekarchi (D-Dist. 13, Warwick), Senate Majority Leader Ryan W. Pearson (D-Dist. 19, Cumberland, Lincoln), and RI State Treasurer James Diossa came to support AARPs efforts advocacy efforts, backing its four priority legislative issues.

“AARP’s mission is to empower people to choose how they live as they age,” said State Director Catherine Taylor, in her opening remarks. At the event, she called on lawmakers to pass AARP Rhode Island’s legislative agenda.

Taylor took this opportunity to share the results of the 2023 AARP Rhode Island Vital Voices survey that reveals that Rhode Island residents age 45+ overwhelmingly would choose to remain in their own communities and own homes as they grow older. “In order for this to be a reality, Rhode Islanders must have financial security in retirement, affordable and accessible housing options, and access to resources that enable them to take care of those they love,” she said.

Let us take a look at AARP Rhode Island’s legislative priorities for this year.

Boosting the State’s Housing Production

With the strong support of House Speaker K. Joseph Shekarchi (D-Dist. 13, Warwick), one of nine Democratic cosponsors of H. 7062, it is expected that House leadership will send the approved committee bill to the floor this week for a vote. The legislative proposal would boost the state’s housing production by allowing a homeowner to develop Accessory Dwelling Units (ADUs) on their property.

ADUs, sometimes referred to as in-law apartments or granny flats, backyard cottages, or secondary units, allow seniors to downsize enabling them to live independently and age in place in their communities. The bill was written in collaboration with AARP Rhode Island, and is one of the aging group’s primary legislative policy goals.

H. 7062, introduced by Rep. June S. Speakman (D -Dist. 68, Bristol/Warren), chairwoman of the House Commission on Housing Affordability, would boost the state’s housing production by making it easier for homeowners to develop ADUs on their property. It would give the property owner the right to develop an ADU within the existing footprint of their structures or on any lot larger than 20,000 square feet, provided that the design complies with local building code, size limits and infrastructure requirements.

Sen. Victoria Gu (D-District 38, Westerly, Charlestown, South Kingstown) will shortly submit a Senate ADU companion proposal but has yet to drop it into the legislative hopper. One Senator noted that there will be technical differences between the House and Senate ADU proposals which will have to be ironed out.

Assisting employees to save for retirement – Secure Choice

Rep. Evan P. Shanley (D-Dist. 24, Warwick, East Greenwich), throws H 7121, The Rhode Island Secure Choice Retirement Savings Program, into the legislative hopper. The bill would establish a convenient, low-cost voluntary retirement savings plan for working Rhode Islanders.

According to AARP Rhode Island, about 40 percent of Rhode Island private sector workers, about 172,000, ages 18 to 64 in 2020 were employed by businesses that do not offer any type of retirement plan.

The retirement savings program, administered by the office of the General Treasurer, would see retirement savings accumulated in individual accounts for the exclusive benefit of the participants or their beneficiaries. The bill would see no fiscal impact on the state’s budget.

H 7121 has been referred to the House Finance Committee for consideration. A companion measure (S 2045) has been introduced in the Senate by Sen. Meghan E. Kallman (D-Dist. 15, Pawtucket, Providence).

Under Shanley’s legislative proposal, the General Treasurer, who serves as the custodian of state funds for the Rhode Island government, would be charged with collecting contributions through payroll deductions and investing these funds in accordance with accounting best practices for retirement saving vehicles. The elected official would also be responsible for setting minimum and maximum contribution levels in accordance with contribution limits set for IRAs by the Internal Revenue Code. The law would become effective for ALL eligible employers within 3 months of the opening of the program enrollment following a phased implementation period.

Caring for Caregivers

Senate Majority Whip Valarie Lawson (D-Dist. 14, East Providence) and Rep. Joshua J. Giraldo (D-Dist. 56, Central Falls) have introduced identical bills in their chambers that would expand Rhode Island’s Temporary Caregiver Insurance (TCI) program from six weeks to 12. It also increases weekly dependent’s allowances from $10 to $ 20 or 7% increase of benefit rate whichever is greater. That would bring the Ocean State in line with other states and allow new parents more time for parental leave and caregivers more time to care for a critically ill family member.

S 2121 and its House companion measure, H 7171, would also expand the definition of critically ill family to include grandchildren, siblings and “care recipients,” defined as individuals for whom the employee is a primary caregiver.

According to AARP Rhode Island, the state’s unpaid family caregiver labor force totals 121,000, providing 113 million care hours per year.

The United States is one of only six countries in the world, and the only wealthy country, without guaranteed parental leave, according to the Bipartisan Policy Center. In recent years some states, like Rhode Island, have stepped up to offer their own programs.

According to a statement released announcing the introduction of S 2121, Rhode Island became the third state in the nation to offer paid parental leave in 2013 when legislators created the TCI program. TCI, which is paid for through payroll deductions, allows new parents to take six weeks of paid leave to bond with and care for their child. It also allows individuals to take this time to care for a seriously family member. That can prove vital for a working adult who needs to care for their spouse after a surgery or a terminally ill parent.

Since 2013, however, many other states have surpassed Rhode Island’s leave offerings. Currently, 11 states and the District of Columbia offer paid parental leave, with two additional states set to offer it beginning in 2026. Most offer 12 weeks, while Rhode Island offers the least amount of time at just six weeks, says the statement.

Finally, it was noted that individuals on TCI in Rhode Island receive 60% of their normal salary. Of the ten states that offer similar programs, most workers receive at least 80%. In Massachusetts, workers receive 80% of their salary for 12 weeks. Workers in nearby Connecticut receive 95% of their salary for 12 weeks.

Cutting Taxes

According to AARP Rhode Island, more than one in five Rhode Island residents, that’s 230,018, receive Social Security benefits. These payments inject more than $ 4 billion into the state’s economy every year.

But Rhode Island is one of 9 states that tax Social Security beneficiaries, says AARP Rhode Island. The state tax on Social Security undermines the purpose of the retirement program, charges the state’s largest aging group, estimating that this program has lifted 50,000 Rhode Islanders 65 or older out of poverty from 2018 through 2020.

Three Senate bills and one House bill have been introduced so far.

S 2061, introduced by Deputy Minority Whip Sen. Elaine J. Morgan (R-Dist. 34, Charlestown, Exeter, Hopkinton, Richmond, West Greenwich), identical to a bill introduced last year, aside from the effective date would allow a modification to federal adjusted gross income for all Social Security income for tax years beginning on or after January 1, 2025.

Sen. Mark P. McKenney (D-Dist. 30, Warwick) has introduced S 2158 and House Deputy Majority Whip Mia A. Ackerman (D-Dist. 45, Cumberland, Lincoln) just submitted H 7588. These identical bills would gradually phase in modifications to the federal adjusted gross income over a four-year period for Social Security income, from 25% up to 100%, beginning on or after January 1, 2025.

And, Sen. Walter S. Felag, Jr. (D-Dist. 30, Bristol Tiverton Warren) legislation, S 2058, would increase the federal adjusted gross income threshold for modification for taxable social security income. This act would also amend references to the federal adjusted gross income as it pertains to modification of taxable retirement income from certain pension plans or annuities.

To watch AARP RI’s legislation reception, held Feb. 8, 2024l, go to https://capitoltvri.cablecast.tv/show/214?site=1.

For obtain the results of the 2023 AARP Rhode Island Vital Voices survey, go to:

To access all of Herb’s articles published by RINewstoday, go to https://rinewstoday.com/herb-weiss/

Herb Weiss, LRI -12, is a Pawtucket-based writer who has covered aging, health care and medical issues for over 43 years. To purchase his books, Taking Charge: Collected Stories on Aging Boldly and a sequel, compiling weekly published articles, go to herbweiss.com.

.