Search Posts

Recent Posts

- Rhode Island Weather for March 31, 2025 – Jack Donnelly March 31, 2025

- Our Networking Pick of the Week – Bend Studio & Brew Cafe House with So. RI Chamber March 31, 2025

- Rhode Island’s last landfill is running out of room – ecoRI News March 31, 2025

- Women’s History Month reflection – Mary T. O’Sullivan March 31, 2025

- Changes coming to HHS elicit strong response from aging network – Herb Weiss March 31, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

RI Veterans: Did you know? 01.02.24 (taxes, disabilities, events, Job Lot, more) – John A. Cianci

by John A. Cianci, contributing writer on veterans issues

We start off with questions from our readers

Q – Do I need to file a tax return if my only income is VA disability? Peter, Smithfield

A – In most cases, NO.

From the IRS website:

Use the Interactive Tax Assistant to help determine the need to file. The Interactive Tax Assistant is a tool that provides answers to many common tax law questions based on an individual’s specific circumstances. Based on user input, it can determine if they should file a tax return. It can also help them understand:

- Their filing status

- If they can claim a dependent

- If the type of income they have is taxable

- If they’re eligible to claim a credit

- If they can deduct expenses

The user’s information is anonymous and only allows the assistant to answer the taxpayer’s questions. The assistant will not share, store or use information in any other way, nor can it identify the individual using it. The system discards the information the user provides when they exit a topic.

Some taxpayers should consider filing, even if they aren’t required to

People may want to file even if they make less than the filing threshold, because they may get money back. This could apply to them if they:

- Have had federal income tax withheld from their pay

- Made estimated tax payments

- Qualify to claim tax credits like:

- Earned income tax credit

- Child tax credit

- American opportunity tax credit

- Credit for federal tax on fuels

- Premium tax credit

- Health coverage tax credit

- Credits for sick and family leave

- Child and dependent care credit

Q – Do I need to claim my monthly Veterans Administration disability amount on my tax return? Roger, West Warwick

A – Disability benefits received from the VA should not be included in your gross income. Some of the payments which are considered disability benefits include:

- Disability compensation and pension payments for disabilities paid either to Veterans or their families,

- Grants for homes designed for wheelchair living,

- Grants for motor vehicles for Veterans who lost their sight or the use of their limbs, or

- Benefits under a dependent-care assistance program.

Veterans Could Be Entitled Thousands of Dollars In IRS Refunds for Past Years

Were you separated by the military and received a lump sum payment which federal income tax was withheld? If yes, and years later you received VA disability and the VA withheld VA disability payments until the separation pay was repaid , you could be eligible for hundreds, if not thousands of dollars of a refund. The refund, more than likely, would be more than the federal income tax withheld from the separation pay and the adjusted gross income deducting the separation pay from the federal tax return for the year filing.

VETTIP: In my case, I received separation pay in 1996, which was taxed. Almost 10 years later, I won an appeal on my VA claim, however, the VA informed me I had to repay the separation pay of almost $30,000 before I could receive the monthly VA disability check. More disturbing, the amount VA included the gross amount of separation pay, estimated $30,000, not the after-tax amount I received, estimated $24,000. Whereas, the separation pay at the time of separation was considered taxable, I had to include the amount in my 1996 federal tax return. The additional estimated $30,000 of gross income from the separation pay put me in a higher tax bracket, which resulted in additional federal and state taxes.

10 years later upon winning my appeal, the VA notice including details on the requirement of repaying the separation pay before I would start receiving my VA disability pay. And the amount was the entire $30,000. Included in the letter from the VA, was required information I needed to do to amend my 1996 tax return to amend taxable income of the estimated $30,000 separation pay, which was now tax free, even thou it was almost 10 years after I filed.

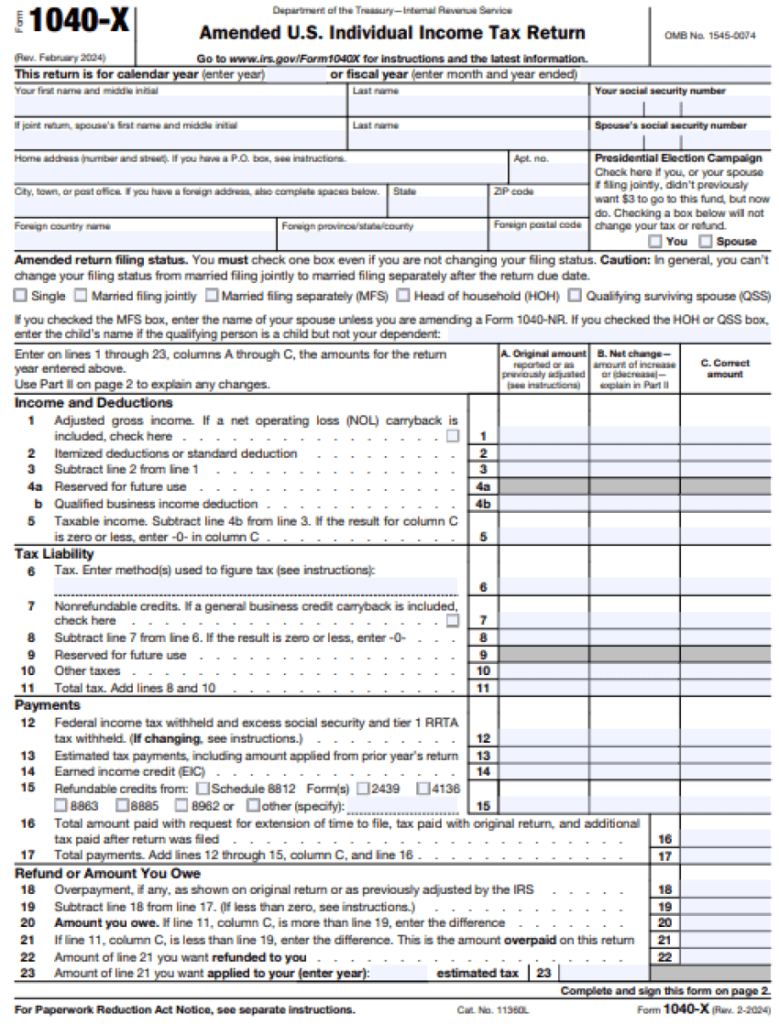

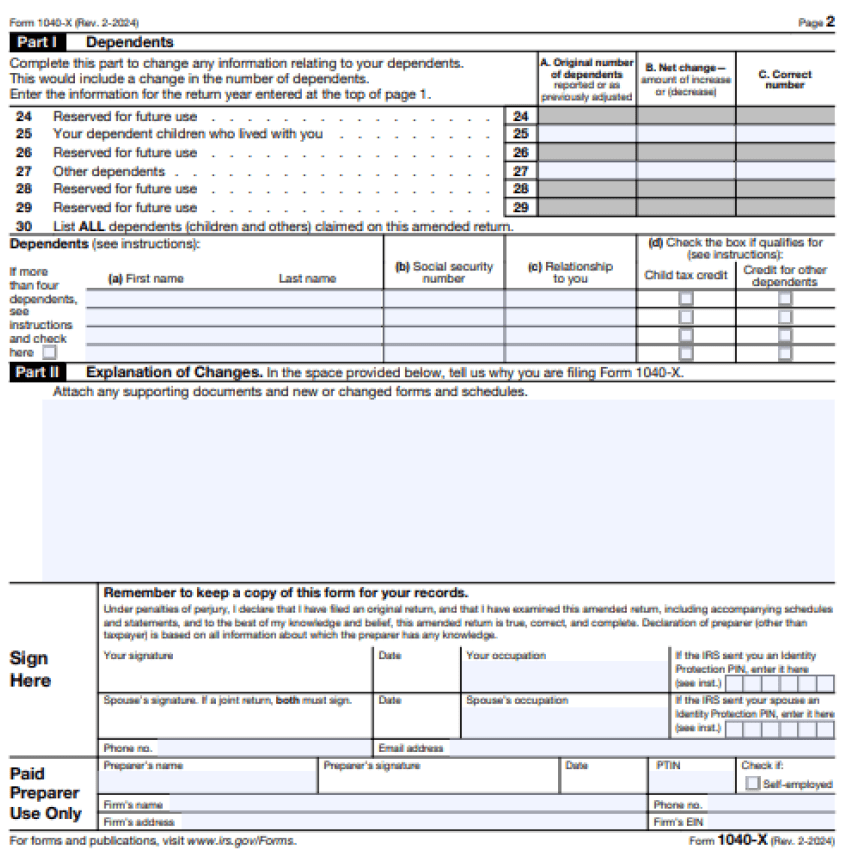

I had to file a 1040-X (see below) https://www.irs.gov/forms-pubs/about-form-1040x

VETTIP: Although the IRS rules read “Taxpayers generally have three years from the date they filed their original tax return to file Form 1040-X to claim a refund. They can file it within two years of the date they paid the tax, if that date is later.” However, the IRS will process a veteran’s amendment with the understanding the VA time process takes more than 3 years. In my case, completing a 1040-X in 2016 for tax year 1996, I received additional refund of almost $3000 after filing the 1040-X and attaching the VA letter I received informing me of withholding of benefits until the separation pay is repaid.

In 2017, the Combat-Injured Veterans Tax Fairness Act of 2016, went into effect in 2017. Under this federal law, Veterans who suffer combat-related injuries and are separated from the military are not to be taxed on the one-time lump sum disability severance payment they receive from the Department of Defense. This law instructs DoD to identify Veterans who were taxed in order for them to file an amended return to receive their refund. Go to Combat-Injured Veterans Tax Fairness Act Claim Information for more details.

*VETTIP: In layman’s terms, if you received a lump sum upon separation for a medical reason, the Combat-Injured Veterans Tax Fairness Act of 2016, went into effect in 2017, AND you should have not paid any federal income tax on the amount, AND RECEIVED a DOD Letter.

If you are a veteran who believes you are entitled to a refund because of separation pay, the Italian American War Veterans of US (ITAM) Veteran Service Officer, (401) 677-9838 or [email protected]. who will provide FREE assistance to the veteran (1) to gather needed documents (to complete and file a 1040-X for the applicable year. If you are a military retiree and receive your disability benefits from the VA, see IRS Publication 525 for more information.

REMINDER FOR VETERAN HOMEOWNERS IN RHODE ISLAND:

File for veteran tax credit at your town or city hall:

Time is running out for veterans, spouses of deceased veterans, and gold star parents to apply and receive real estate tax credit that could save them an average of $250 off their annual real estate tax. Simply put, if you’re an honorably discharged veteran and or a spouse of a deceased veteran, YOU ARE ELIGIBLE for an estimated $250 dollars off your annual real estate tax. This tax credit is in addition to any other credit can you are receiving ( senior, homestead, etc…)

FAQ

I’m a widow of a veteran and my husband never applied?

You are eligible, go to town or city hall and apply. You will need discharge papers.

I don’t have discharge papers?

The fastest way to get copies of discharge papers is contact a U.S. Senator or U.S Congressperson. Ask for the veteran’s liaison. Explain to their office the urgency to get the discharge paperwork. Immediately after receiving, go to the city or town hall to apply for the credit. If you miss this year’s deadline, still apply as it will be good for next year and all future years.

I brought my DD214 to town hall and was told I was not eligible?

Almost every veteran who served since 1947 is eligible. Definition of veteran for credit, is someone who served in the U.S Armed forces and has an honorably discharge.

It appears whoever you spoke with was unaware of the passage of a bill making eligible Cold War veterans who served between 1947 and 1991. And from 1991 to current, since the U.S. has been in a state of war since Operation Desert Shield/Storm.

To be eligible, you need not have served in a war zone, however, you do need to have a DD214 showing a time period of active duty from 1947 to 1991 and have received an honorable discharge.

VETTIP: Local towns and cities require a one-time application for the veteran property time exemption. Moreover, all towns and cities have a deadline date to file for the veteran exemption before the annual tax bills are compiled. For the Town of Tiverton, Jim would have needed to file by March 15 2024, for tax bills issued in July 2024.

The bills passed qualifying you as a Cold War veteran for the veteran exemption are Rhode Island House bill 2021 — S 0982 and Rhode Island Senate bill 2021 — S 0982. Governor Dan McKee signed the bills into law on July 14, 2021, extending veteran tax exemption to veterans who served during the Cold War.

VETTIP: If you are a veteran or widow, own property (house, condo, land etc.) and have a copy of DD214 supporting the veteran served on active duty from 1947 to current, more than likely you are eligible for an annual local property tax worth hundreds of dollars. Emphasis, the veteran did not have to serve overseas or in a combat zone to be eligible for the tax credit.

___

Ocean State Job Lot partners with customers to donate 63,000 winter coats to Veterans in need in 9 states

Ocean State Job Lot (OSJL) announced that its 2023 “Buy, Give, Get” program has resulted in the collection of 63,000 winter coats, surpassing the company’s goal of 55,000 coats to be donated to veterans in need this winter.

From October 2023 through early January 2024, customers at each of the closeout discount retailer’s 153 stores across the Northeast were encouraged to buy a quality, brand-name men’s or women’s winter coat for $40.00 (retail value at $120.00 or more), give it back to the store as a donation to a veteran in need, and then get a $40.00 Crazy Deal Gift Card for free, to be used for a future purchase online or at any Ocean State Job Lot store.

The coats have been distributed to veterans’ organizations throughout the winter season in partnership with a multi-state network of more than 50 veteran support agencies, organizations, assistance programs and action groups serving New England, New York, New Jersey, and Pennsylvania. Since the start of “Buy, Give, Get” in 2016, OSJL has provided over 300,000 coats to veterans in need and 200,000 backpacks to children in underserved communities.

“We are so thankful to our generous and loyal customers who participated in the 2023 program,” said David Sarlitto, Executive Director, Ocean State Job Lot Charitable Foundation. “What started out as a small program has grown into one of the largest of its kind serving veterans in need across the Northeast. We are especially proud to have exceeded our goal of coats and look forward to building on that success next year.”

On October 23, 2023, Officers from the Westerly, Rhode Island Police Department stopped by the Westerly Ocean State Job Lot store and purchased 34 Buy-Give-Get coats for the community. The officers used the gift cards they received for the donation for their annual toy drive to help local families in Westerly.

___

EVENTS

Saturday, February 3, 2024 – FREE Breakfast for veterans and guest. 8:30 to 10:00 a.m, Swansea, Christ Church Parish, 57 Main Street. Open to all veterans and their guest. Building Bridges is sponsor, who also is a partner in the monthly FREE luncheon the third Monday of every month at VFW 5392, Tiverton RI.

Monday February 5, 2024 – Federal Hill Veteran Coffee House, ROMA, 900am to 1100am, 311 Atwells Ave, Providence RI. Open to all veterans and their guest. FREE REFRESHMENTS, to include complementary Italian Toast by ROMA.

Monday February 19 – FREE LUNCHEON for all veterans and their guest at VFW 5392, 134 Shove Street, Tiverton RI from 1130 am to 1300pm. The luncheon will be traditional Portuguese food cooked by guest combat veteran chefs, Jay Caetano and Mike Bozzi.

___

State of Rhode Island Benefits for Veterans Receiving 100% VA Disability

Free Rhode Island Vehicle Registration and Driver’s License for Disabled Veterans: Wartime Veterans with serious disabilities may be exempt from Rhode Island vehicle registration and driver’s license fees. Who is eligible Free Rhode Island Vehicle Registration and Driver’s License for Disabled Veterans? To be eligible Veterans must have received an honorable discharge for service in the U.S. Armed Forces during a wartime period and meet one of the following requirements:

- Lost or lost the use, one or both of their arms, hands, feet, or legs

- Received a grant from the VA for a specially adapted vehicle

- Received a VA combined, service-connected disability rating of 100%

- Rated “individually unemployable” due to a service-connected disability Free Rhode Island Disabled Veteran License Plate: The Rhode Island Disabled Veteran License plate is available to Veterans who have a 100% disability rating from the VA. These plates may be used on private or commercial vehicles weighing 6,300 lbs. or less. There is no initial or renewal fees for this license plate. Only one set of plates is authorized. Plates may be transferred to the unremarried Surviving Spouse. Veterans are required to provide a copy of their discharge papers (DD214 or other official proof of military service) and must request official documentation from the Providence VA Regional Benefits Office indicating they have a 100% disability rating before they apply. Providence VA Regional Benefits Office 380 Westminster Street

Providence, RI 02903 Phone: 800-827-1000

___

Travel/Entertainment for Veterans

Free Golf, Goddard Park Golf Course Fee Exemption for Totally Disabled Veterans: Rhode Island resident Veterans who have a 100% permanent and total, service-connected disability rating from the VA are exempt from paying any fees to play golf at the Goddard Park Golf Course. For more information year-round at Division Headquarters at 401-667-6200.

Free Rhode Island Hunting and Fishing Licenses for 100% Disabled Veterans: A Veteran who has a 100% disability rating from the VA is eligible for free Rhode Island hunting and fishing licenses. No cost licenses are available if you are: over 65 AND a Rhode Island resident – a veteran with 100% disability status from the Department of Veterans Affairs – a person with 100% total disability status from the Social Security Administration

To apply in person at DEM, bring a photo ID and an ORIGINAL DOCUMENT OF THE FINAL DECISION(S). Office hours are 8:30 a.m. to 3:30 p.m. Monday through Friday. (directions)

To apply by mail, complete an application and mail the application and a copy of your photo ID and the ORIGINAL DOCUMENT OF THE FINAL DECISION(S). Allow two weeks for processing.

The address to obtain your license in person or by mail is:

DEM Licensing Office

235 Promenade Street, Room 360

Providence, RI 02908

(401) 222-3576

To purchase online, you will be required to certify that you have an ORIGINAL DOCUMENT OF THE FINAL DECISION(S). You will also be required to enter the date the decision expires. The Department will audit compliance with the certification and may, at any time, request a copy of the current DOCUMENT OF THE FINAL DECISION(S). Failure to submit the documentation by the date requested may result in the suspension of your fishing and hunting license. Also, Rhode Island General Law 11-18-1 prohibits giving false documents to an agent, employee, or public official. The penalty is a misdemeanor punishable by a fine of up to $1,000 or imprisonment up to one year.

Rhode Island Hunting and Fishing Benefits for Service Members and Veterans: Rhode Island offers several hunting and fishing benefits to Service members and Veterans. A short description of each is listed below. Applicants are required to show documentation proving eligibility when they apply:

Active-Duty Service members – Military ID – or, Veterans – DD214 – or, Disabled Veterans – VA Disability Certification Letter ( Contact VA office)

Applicants can apply online at Rhode Island Outdoors, in person at the Rhode Island Department of Environmental Management, Office of Boating Registration and Licenses in Providence (Monday through Friday 8:30 a.m. – 3:30 p.m.), at an Authorized In-Person Sales Agent, or they can mail applications to:

Rhode Island Department of Environmental Management

235 Promenade Street, Room 360

Providence, RI 02908

Phone: 401-222-3576

Free Rhode Island State Park Passes for 100% Disabled Veterans: Rhode Island offers the State Park Disability Pass for use at any state-owned recreational facility to disabled Veterans who have a 100% service-connected disability rating from the VA.

The State Park Disability Pass authorizes free admission and parking but does not exempt the following: Licensing fees – Camping fees – Picnic table fees – Specialized facility use fees – Use of equestrian areas – Performing art centers – Game fields fees – Mule shed fees.

If the disabled Veteran cannot drive, the vehicle transporting the Veteran will not be charged.

___

Resources & ongoing groups

Below are all the groups the Providence Vet Center is currently offering. As this list changes, I will provide updates. Please send me any questions that you may have, thank you for your time!

***All Vet Center Groups require that the Veteran be enrolled with the Vet Center prior to attending. To check eligibility or for questions, please contact the Vet Center at (401) 739-0167 or reach out to our Veteran Outreach Program Specialist (VOPS) via email at [email protected]***

Post-Traumatic Stress Disorder Group (PTSD) – 2nd and 4th Tuesday of the month from 2:00 – 3:30 p.m. (Group is only active September through May)

Global War on Terrorism (GWOT) and Vietnam Veterans PTSD Group – 2nd and 4th Wednesday of the month from 9:30 – 11:00 a.m.

Vietnam Veteran PTSD Group – 1st and 3rd Monday of the month from 10:30 – 12:00 p.m. and 5:30 p.m. – 7:00 p.m.

Art Expression Group – Every Thursday from 9:00 – 12:00 p.m.

Operation Enduring Freedom (OEF)/Operation Iraqi Freedom (OIF)/Operation New Dawn (OND) Group – Every Wednesday from 11:00 – 12:00 p.m.

Stress Management – Every Thursday from 9:00 – 10:00 a.m.

Low Impact Walking Group – Every Tuesday from 9:00 – 10:00 a.m.

Guitar 4 Veterans – Every Wednesday from 7:00-8:30 p.m.

Monday Mindfulness Group – Every Monday from 10:00 – 11:00 a.m.

Yoga Group – Every Friday from 12:00 – 1:00 p.m.

Moral Injury Group – Every Friday from 10:00 – 11:00 a.m.

Modern Warrior Support Group – 1st and 3rd Monday of the month from 2:30 – 4:00 pm.

If you are attending the group for the first time, double check with the Vet Center in case of last minute schedule changes.

___

Discount Offers

Services

No Problem Plumbing and Heating LLC: 15% military discount, ask for Ron Gaynor, (401) 568-6666. Veterans must provide proof of eligibility with a VA Card, VA ID Card, or RI State license with veteran identification.

Restaurants

Applebee’s – Military Discount. With more than 2,000 locations, Applebee’s is a family grill restaurant. Applebee’s gives 10% off for active duty and veteran. Last verified 07/31/2022.

Denny’s – Hartford Ave, Johnston offers 10% discount for veterans and active duty. Denny’s is a table service diner-style restaurant chain. Last verified 07/31/2022.

Outback Steakhouse – 10% Discount to active and veterans. Last verified 07/28/2021

99 Restaurant & Pub – The 99 Restaurant & Pub offers a 10% military discount to members of Veterans Advantage. Available at select locations only. Bring valid military ID

Retailers

Advance Auto Parts – 10% for Active Duty, Veterans, and families. Last verified 07/28/2021

Bass Pro Shops – Offers a 5% discount to active-duty military, reservists, and National Guard. Sign up and verify your status online or bring your military ID when you shop at your nearest Bass Pro store (source).

BJs Wholesale – Reduced membership fee. BJ’s offers all military personnel over 25% off their Membership. Last verified 07/28/2021

Lowes – Enroll in the Lowe’s Military Discount Program to activate your 10% discount – “Our way of saying Thank You” to our active duty, retired and military veterans and their spouses with a 10% discount on eligible items. Verification of your military status is fast and easy through our partner, ID.me, our trusted technology partner in helping to keep your personal information safe.

GameStop – is offering a 10% in-store military discount on all pre-owned products, collectibles, and select new products. Available to current and former military members who bring any valid proof of service or when they verify through ID.me

Home Depot – Offers a 10% off military discount on regularly priced merchandise for in-store purchases for active duty, retired military, and reservists at participating locations. Customers are required to show a valid government-issued military ID card to redeem this offer.

Kohls – 15% discount offers for active military, veterans, retirees, and their immediate family members a 15% discount on purchases made on Mondays, in store only. In order to receive the military discount, eligible customers must present proper identification along with any tender type.

Jiffy Lube – HONORING VETERANS ALL DAY EVERY DAY! – We didn’t want to wait for Veteran’s Day to express our appreciation and gratitude for your service. That’s why every Team Car Care owned and operated Jiffy Lube® service center is offering our BEST discount of 10% OFF as a “Thank You” to the men and women of our Armed Forces for their service to our country. *Disclaimer*- I.D. required. No coupon is required. Excludes batteries and brakes, alignment, and diagnostic services. Available only at 3 select locations: Tioque Ave, Coventry RI – Bald Hill Road, Warwick RI – Park Ave, Cranston RI

Michaels – offers a 15% off military discount on the entire in-store purchase including sale items for active duty, retired military, guard, reservists, veterans, and family members. How to get: 1. Create an account. Log in to Michaels Rewards. 2. Get verified. Provide your military information to get verified, instantly. 3. Go shopping! To use your discount online and in store, just sign into your account or provide your Michaels Rewards phone number at checkout.

O’Reilly Auto Parts – 10% discount on in store items for Active Duty, Veterans and families. Last verified 3/4/21.

___

If you are a retailer and or a veteran aware of a business not listed above, please forward to: [email protected]: the business’s name, location, and military and veteran discount offered.

If you have an event, meeting, other pertinent veteran information, or email questions or help needed, contact the Italian American War Veteran Service Officer, John A Cianci, [email protected], ITAM Office 1-(401)677-9VET(9838)

___

To read all columns in this series go to: https://rinewstoday.com/john-a-cianci/

John A. Cianci is a Veteran Service Officer. Retired, U.S. Army MSgt., Persian Gulf War and Iraq War combat theater.

Cianci, a combat disabled Veteran, served in Desert Shield/Storm and Operation Iraqi Freedom. His awards include Bronze Star, Combat Action Badge, Good Conduct, and others.

Cianci belongs to numerous veterans organizations – Italian American War Veterans, American Legion, Veterans of Foreign War, and many more organizations. He is an active volunteer assisting veterans to navigate federal and state benefits they have earned. He is Department of Rhode Island Department Commander Italian American War Veterans and Veteran Service Officer.

He is a graduate of Roger Williams University (BS Finance), UCONN business school* (Entrepreneur Bootcamp for Veterans), Solar Energy International Residential, Commercial and Battery Based Photovoltaic Systems certificate programs, numerous certificates from the Department of Defense renewable energy programs, including graduate of the Solar Ready Vets Program.